EUR/USD Price Analysis: Prospects of a significant correction from key monthly structure

- EUR/USD bears move in on a critical area of support.

- There are prospects of a significant correction should the 0.96s hold up.

The US dollar strengthened on Monday on a volatile day to start the week which had EUR/USD slipping to 0.9552 from 0.9694. The single currency has dropped to a major level on the monthly chart and the following illustrates the market structure and prospects of either a deeper move lower or a significant correction.

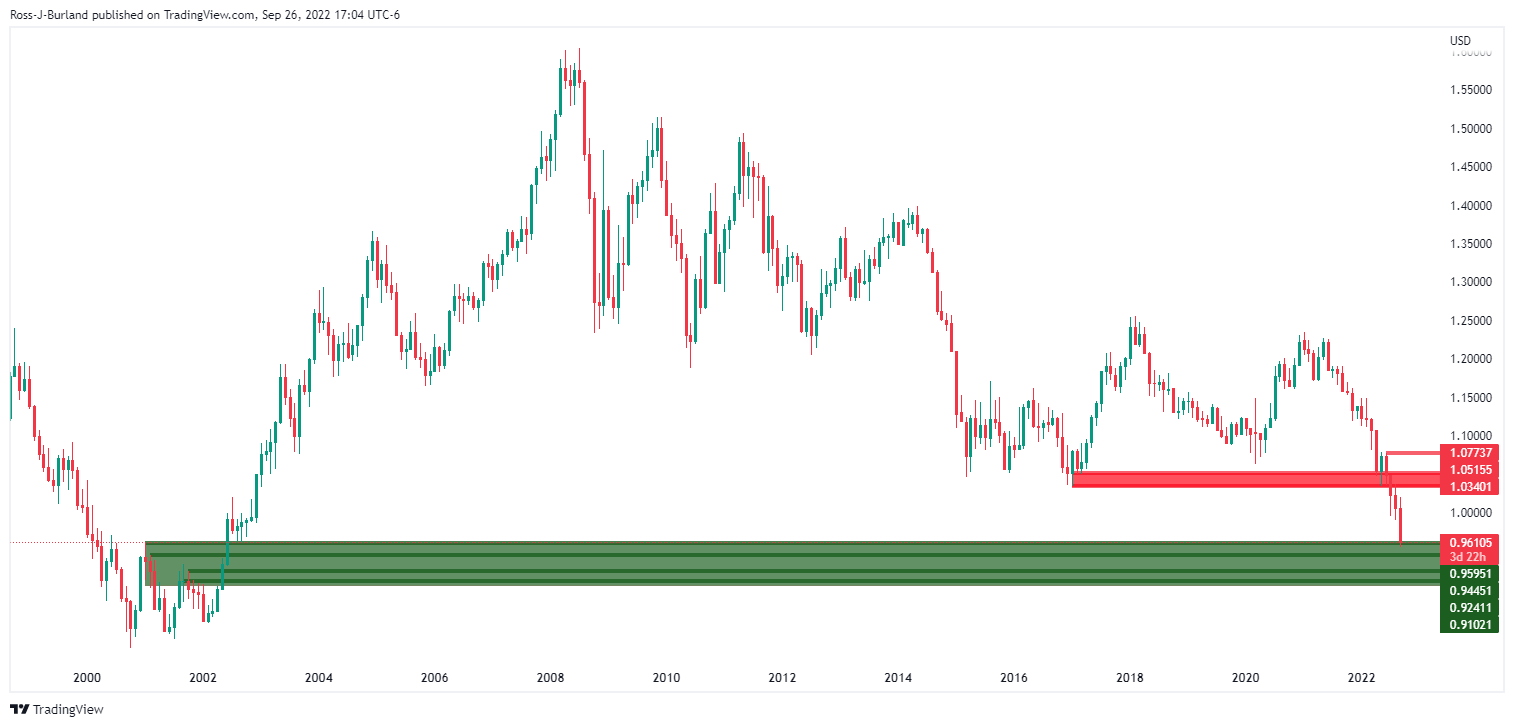

EUR/USD monthly charts

The weekly charts above see the price of the euro running into a monthly support area following a major move to the downside. Should the price extend further lower on a break of the current structure at 0.9595, a move to 0.9445 guards the 0.9240s and 0.9100s.

EUR/USD weekly chart

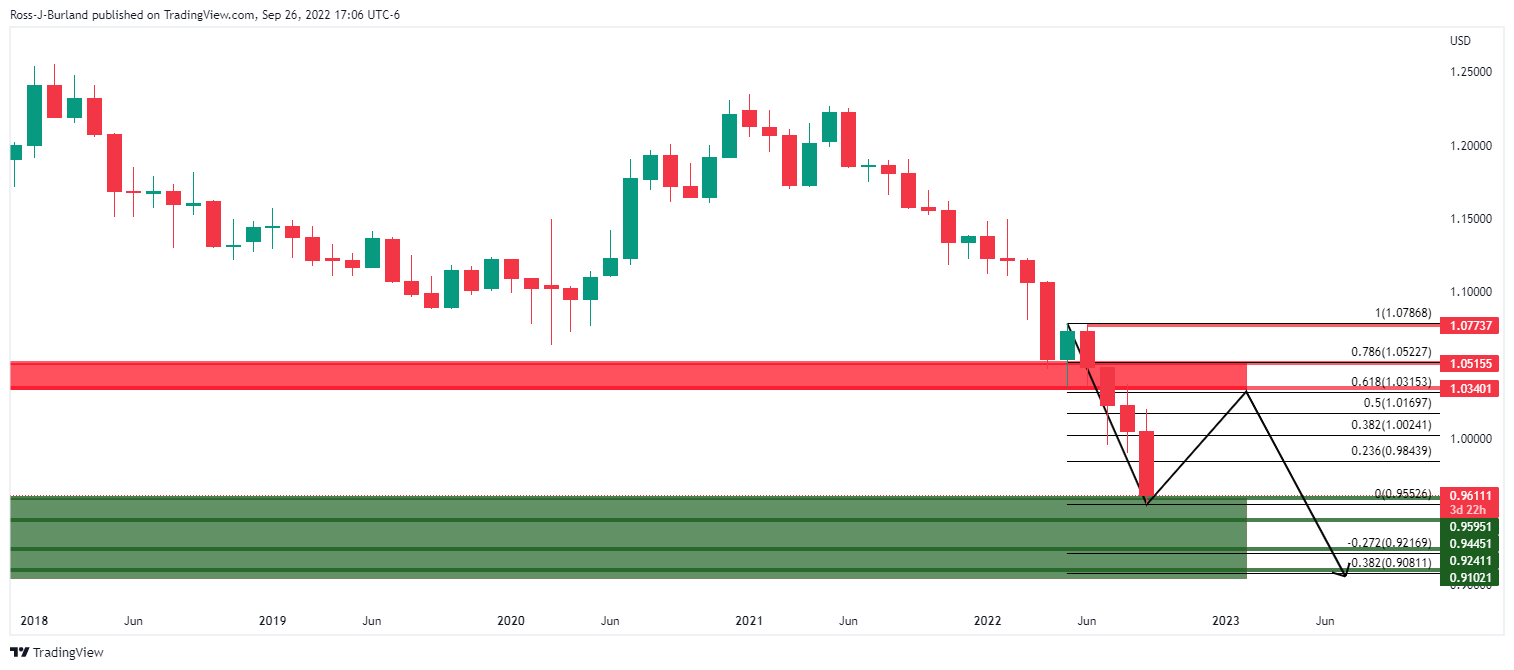

On the other hand, a reversion as per the weekly chart, above, and the daily chart, below, could be in order for the foreseeable future prior to the next move to the downside should this current support around 0.9600 the figure hold up.

EUR/USD daily chart

On the daily chart, we have confluences of the 78.6% and 61.8% ratios aligning with resistance structures at levels that would require a prolonged commitment from the bulls.