EUR/USD extends the upside further north of the parity level

- EUR/USD keeps the gradual upside well in place above parity.

- Germany Producer Prices surprised to the upside in August.

- Chair Lagarde is due to speak later in the European afternoon.

The single currency keeps the bid bias well in place for yet another session and this time lifts EUR/USD further north of the key parity region on Tuesday.

EUR/USD looks to Lagarde, Fed

EUR/USD advances for the fifth consecutive session and looks to consolidate the breakout of the parity region amidst the persistent loss of upside momentum in the greenback.

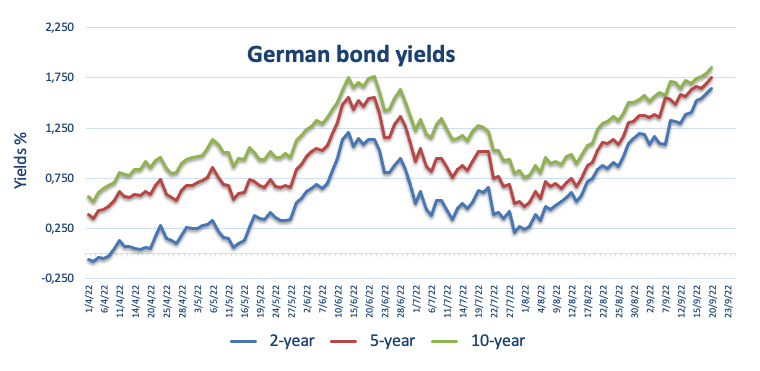

The pair’s improvement comes in tandem with further gains in the German 10-year Bund yields - which trade in new 3-month tops near the 1.90% level – along with the relentless advance in their US peers, all ahead of the FOMC gathering. On the latter, conviction among investors of a 75 bps rate hike on Wednesday appears well anchored for the time being.

In the domestic calendar, Producer Prices in Germany rose 7.9% MoM in August and 45.8% from a year earlier. Later in the session, ECB’s Chair C.Lagarde will speak at an event in Frankfurt.

Across the pond, Housing Starts and Building Permits during August will take centre stage.

What to look for around EUR

EUR/USD extends further the gradual recovery from recent lows in the sub-parity zone against the backdrop of the slow march south in the dollar.

So far, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals.

Key events in the euro area this week: ECB Lagarde (Tuesday) – Flash Consumer Confidence (Thursday) – EMU, Germany Flash Manufacturing/Services PMI (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is gaining 0.12% at 1.0034 and the immediate resistance comes at 1.0097 (55-day SMA) seconded by 1.0197 (monthly high September 12) and finally 1.0305 (100-day SMA). On the other hand, a breach of 0.9944 (weekly low September 16) would target 0.9863 (2022 low September 6) en route to 0.9859 (December 2002 low).