Back

15 Aug 2022

Crude Oil Futures: Door open to extra weakness

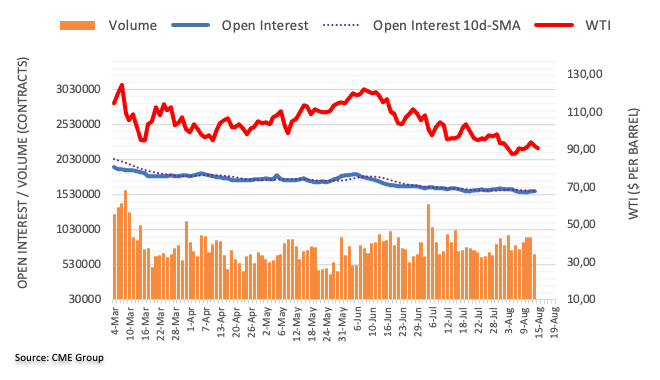

CME Group’s flash data for crude oil futures markets noted traders added around 2.5K contracts to their open interest positions on Friday, reaching the second daily build in a row. Volume, instead, shrank markedly by around 245.3K contracts after three consecutive daily builds.

WTI remains limited by the 200-day SMA

Prices of the barrel of the WTI gave away part of the weekly advance on Friday amidst increasing open interest. Against that, the continuation of the corrective downside now appears on the cards with the immediate target at recent lows near the $87.00 mark per barrel (August 5). So far, occasional bullish attempts in crude oil remain capped by the key 200-day SMA, today at $95.50.