AUD/USD Price Analysis: There could be more to come from the bulls on a break of 0.6900

- AUD/USD bears are in control, for now, and target a break of 0.6900.

- The bulls could be lurking not far below.

As per the prior series of analyses this week so far, AUD/USD Price Analysis: A break from 0.6950 is on the cards, AUD/USD bulls seek a break of 0.6925 for 0.6950 target area, AUD/USD Price Analysis: The break into 0.6930s has summoned the bulls to target the 0.6950s, the pair continues to play the ranges but the bias stays with the upside longer-term.

AUD/USD daily chart scenarios

The M-formation's neckline failed to fend off the bulls and the high lows may have invalidated the bearish prospects of a move towards 0.67 and 0.66 in the meantime.

Instead, as illustrated below, the volume profile and price imbalances to the upside could make for a path of least resistance as follows:

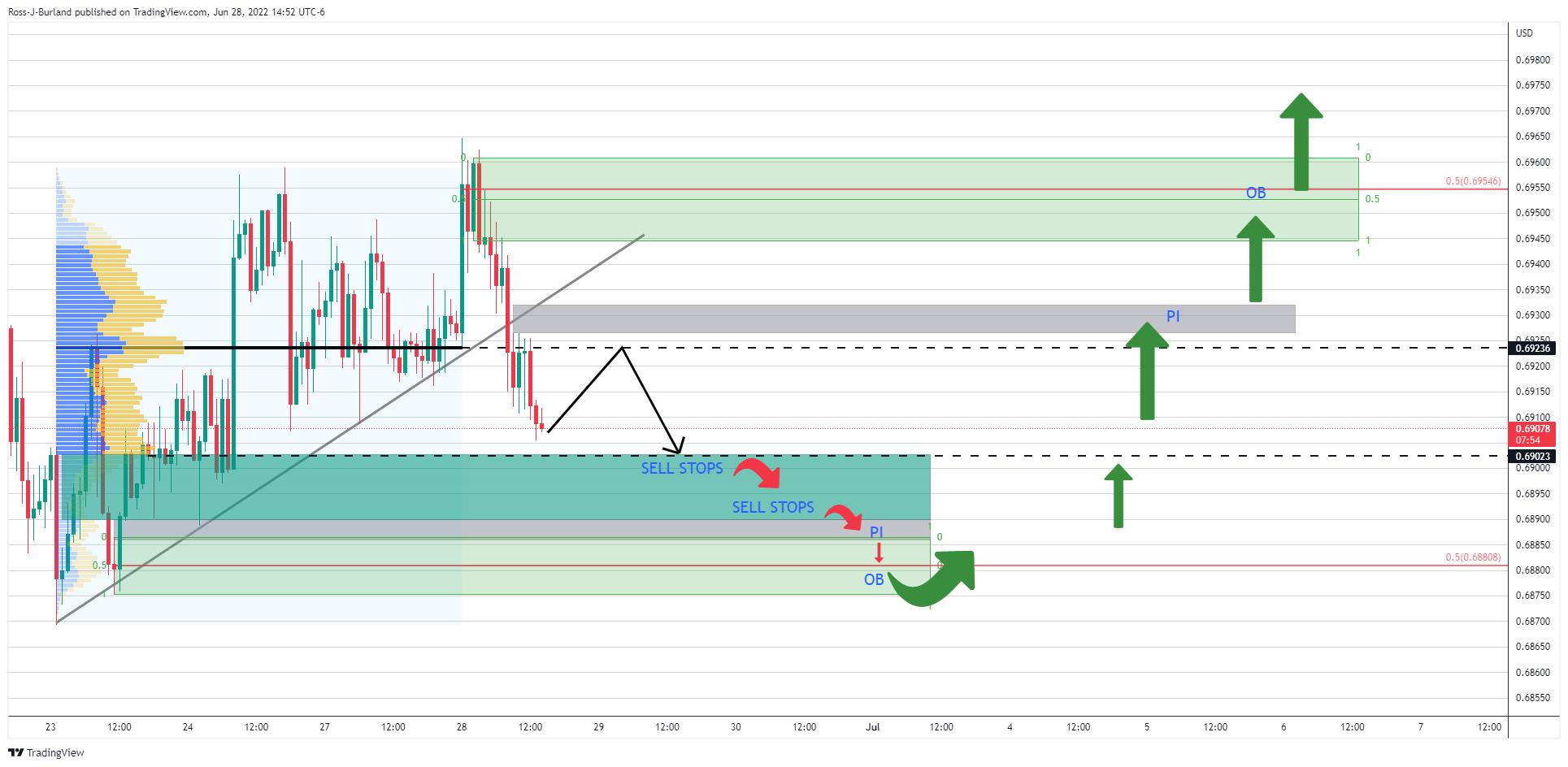

AUD/USD H1 chart sell-buy scenario

From a shorter-term outlook, there is the possibility of a liquidity grab from below high volume areas into buyer's protective stops and fresh sell orders in anticipation of a longer-term bear trend, encouraged by the moves lower from 0.6950.

If this were to play out, then 0.6870/80 could be an area of renewed demand as per the mod point of the bullish order block. A short squeeze could eventuate in a surge higher and a bullish trend into higher liquidity and price imbalance mitigations on the daily chart.