AUD/JPY Price Analysis: Bulls flex muscles above 92.00 with eyes on RBA

- AUD/JPY extends the previous day’s rebound, remains firmer around intraday high.

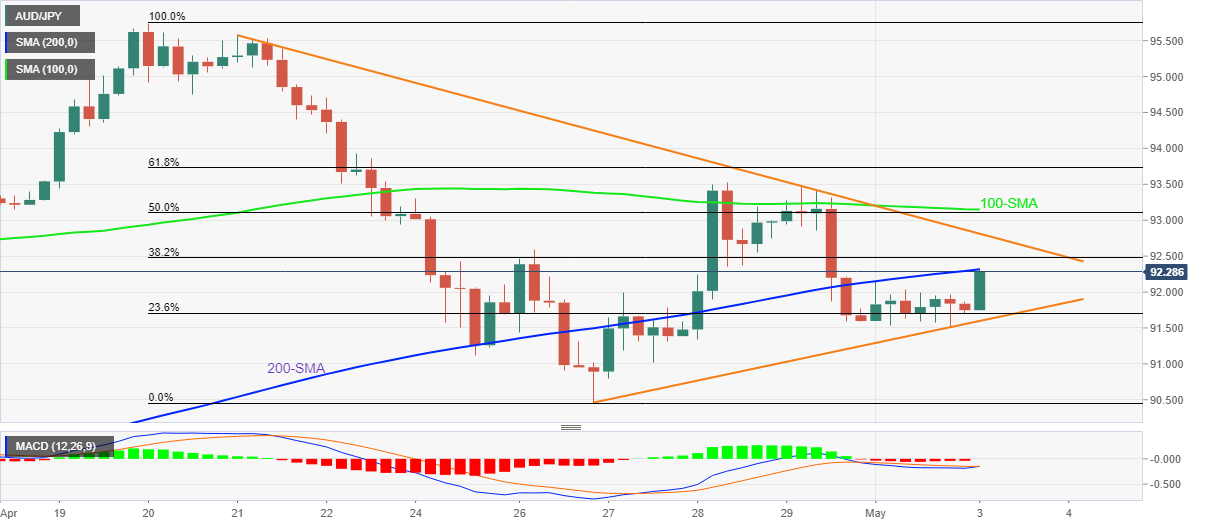

- MACD teases bulls but the key SMA, symmetrical triangle challenge upside momentum.

- Reserve Bank of Australia Preview: Will a 15 bps rate hike be enough to lift the aussie?

AUD/JPY picks up bids to refresh intraday high around 92.25 during the pre-RBA run-up on Tuesday.

In doing so, the cross-currency pair respects the recently bullish MACD signals while approaching the 200-SMA resistance near 92.30. Also favoring the AUD/JPY buyers are the hopes of a 0.15% rate hike from the Reserve Bank of Australia (RBA), its first rate lift since late 2010.

Even if the quote rises past 92.30, a downward sloping trend line from April 21 and the 100-SMA, respectively around 92.80 and 93.15, will challenge the pair’s further upside.

Alternatively, pullback moves remain elusive until staying beyond the weekly support line, at 91.60 by the press time.

Following that, a downside towards late April lows near 90.45 and the 90.00 threshold can’t be ruled out.

Overall, AUD/JPY remains on the front foot ahead of the key event.

AUD/JPY: Four-hour chart

Trend: Pullback expected