Gold Price Analysis: XAU/USD trapped in clear range, ready to explode – Confluence Detector

- Gold has been struggling to recapture the $1,800 level.

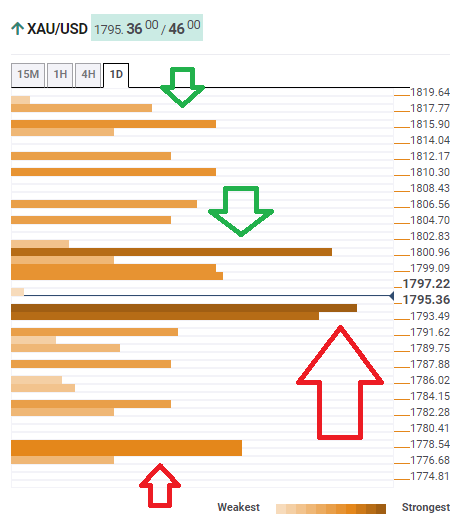

- The Confluence Detector is showing XAU/USD is confined to a narrow range.

- Gold Weekly Forecast: XAU/USD snaps four-week winning streak, eyes on US CPI data

How high is US inflation? That question is keeping traders nervous as it is set to shape the fate of the Federal Reserve's bond-buying scheme. The US releases fresh Consumer Price Index statistics on Tuesday and tensions are mounting and keeping ranges narrow.

XAU/USD is also confined between strong resistance and strong support. According to technical analysis textbooks, that implies a significant move later down the line. While the direction depends on the data, the battle lines are clear.

The Technical Confluences Detector is showing that XAU/USD has support at $1,794, which is the convergence of the Fibonacci 38.2% one-day, the Fibonacci 23.6% one-week, the Simple Moving Average 100-1h and more.

Substantial resistance is at $1,801, which is where the Fibonacci 38.2% one week and the Bollinger Band one-day Middle meet up.

Looking further up, the distant target for gold is $1,815, which is the confluence of the Pivot Point one-day R3 and the 100-day SMA.

On the downside, bears are targeting $1,778, which is a juncture that includes the Fibonacci 61.8% one-month and the PP one-day S2.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence