AUD/USD bulls hang on nervously near 61.8% golden ratio, ECB looms

- AUD/USD bears stay in control mid-week as risk-apatite deteriorates.

- Central bank tapering themes are weighing on global benchmarks and risk associated currencies.

- A break of the 0.7340s opens near term risk to 0.7315.

The Australian dollar is regarded as a currency that is linked to the market's risk profile which is currently being undermined by investors moving to the sidelines as central bank narratives turn more hawkish.

At the same tie, however, there is an air of caution surrounding the spread o the highly contagious Delta coronavirus variant making its way around to the far corners of the world.

Of course, markets are really only paying attention to the spread in nations that matter to them, namely major APAC nations such as Australia, and the big three, the US, China and Europe.

In that regard, Australia has struggled with the resurgence of the virus in the form of the new variant due to its slow uptake on the vaccine rollout.

The Reserve Bank of Australia has responded in kind to the fresh wave and subsequent lockdowns in the economy by cautiously tapering its financial covid relief quantitative easing programme this week.

The RBA QE purchases are now running at A$4bn/week from this month onwards compared to the earlier rate at A$5bn/week.

However, the RBA acknowledged the poorer-than-expected economic outlook and decided to hold the reduced QE pace of A$4bn/week until at least mid-February next year.

The dovish taper sent the Aussie into a tailspin following a session of post-RBA volatility.

The US dollar, in turn, was bid owing to the market's growing risk-off stance following a series of disappointing macroeconomic data that stands to throw the global recovery into a fresh slowdown in the coming months.

This makes for a bearish cocktail in markets, made up of higher inflation prospects, tighter money conditions and the delta variant infections that are yet to show signs of an apex.

Consequently, MSCI's world equity index IACWI closed -1.57% on Wednesday, en route to the 38.2% ratio of the mid-August rally.

Wall Street's benchmarks are lower by various degrees, with the Dow Jones Industrial Average finished down 0.20 %and the S&P 500 ended 0.13% lower. The Nasdaq Composite was also falling by 0.35%on the day, which just goes to show how bearish investors are ahead of the European Central Bank meeting later in this Thursday's Asian session.

Eyes on the ECB

European stocks skidded to their lowest in nearly three weeks as investors fear that central banks might start to taper their asset purchases as soon as this month.

Analysts are expecting purchases under the ECB's Pandemic Emergency Purchase Programme (PEPP) to be reduced to possibly as low as 60 billion euros a month from the current 80 billion, which would be considered a de-facto taper.

The combination of this along with potentially a very cautious stance surrounding the Delta variant and global growth picture could see risk assets fall even further, which would likely fuel a rally in the greenback.

In turn, this would be expected to weigh on the commodity complex and its proxy currency, the Aussie.

On the other hand, a more upbeat outcome and sentiment at the ECB would be expected to support risk and related currencies.

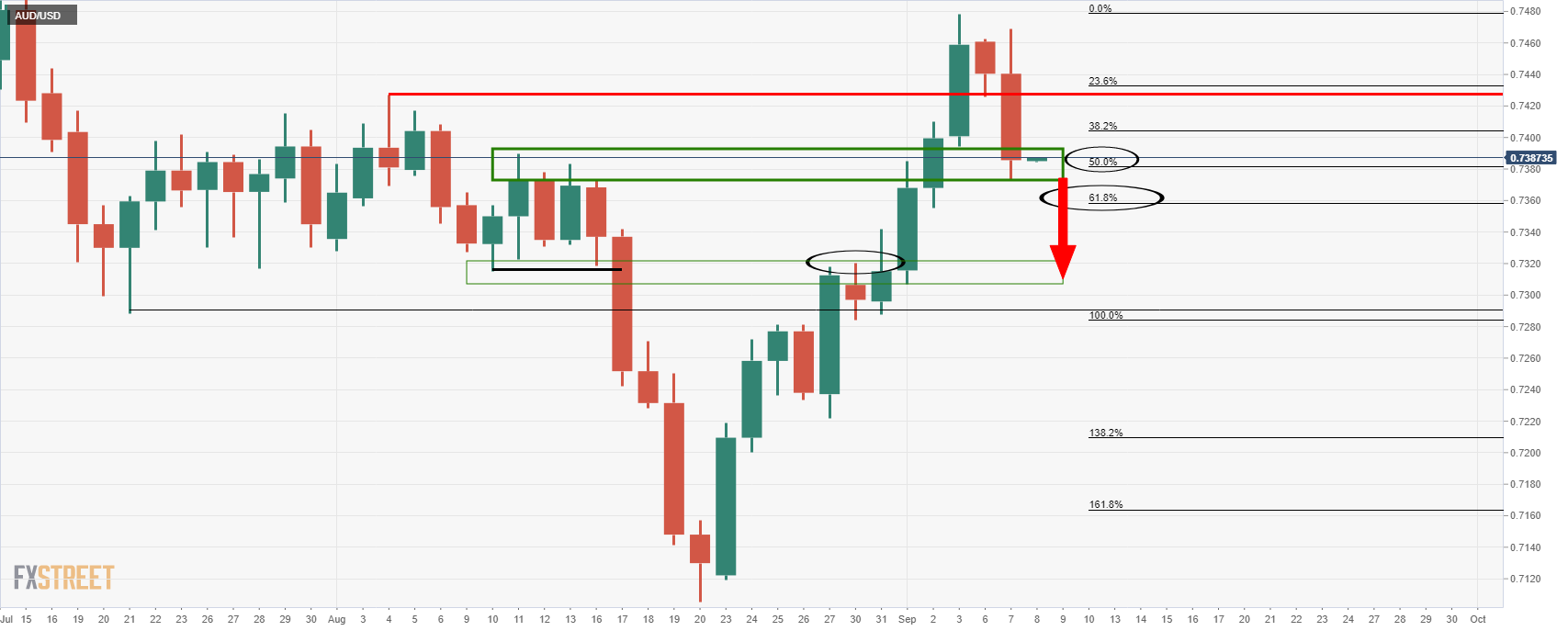

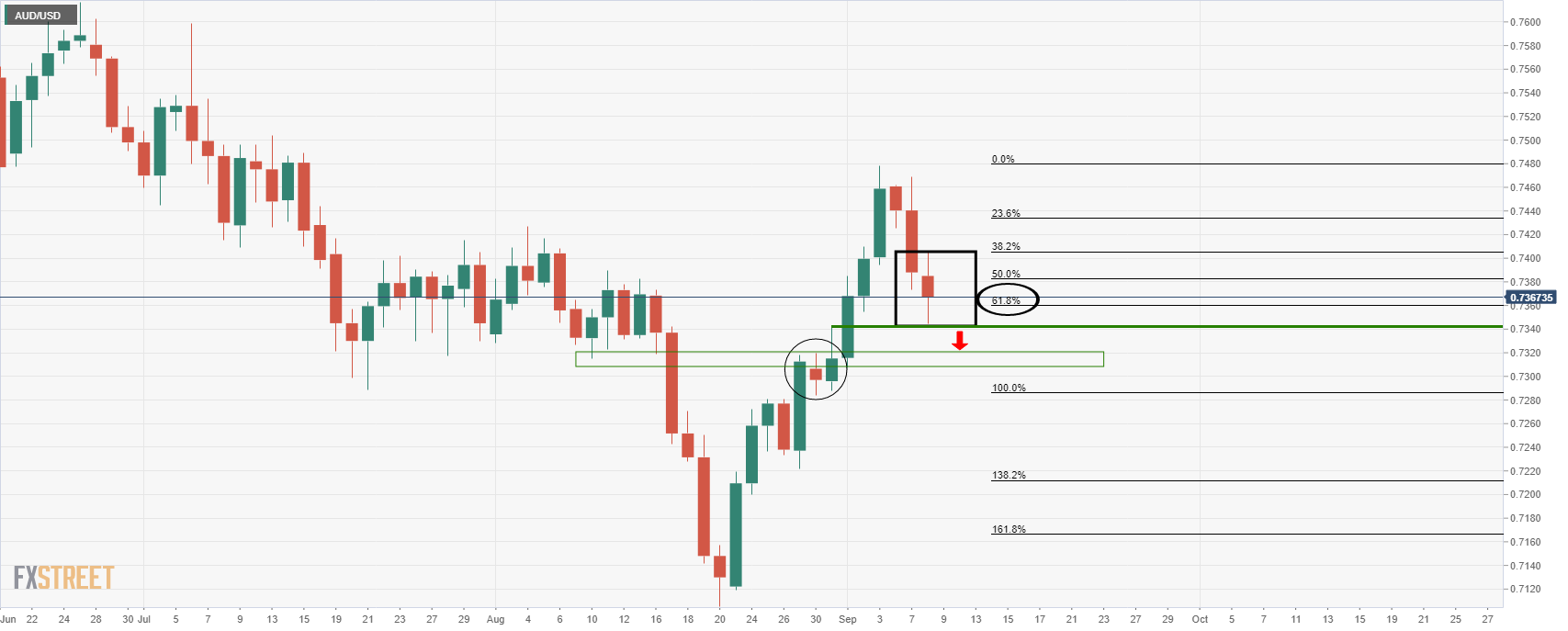

AUD/USD technical analysis

As per the prior day's analysis, where it was stated that ''the price has broken key levels to the downside from a daily perspective.

Bears will be keen to see a test of the 61.8% ratio ahead of the 30 Aug structure around 0.7320 and near 10 Aug lows at 0.7315,'' the price has indeed continued to deteriorate towards the targets.

Live market update

The price has stalled at a prior high and is acclimating near the 61.8% Fibonacci retracement level, aka, the Golden Ratio.

A break there would be significantly bearish and leave the target exposed to a highly probable test.

Therefore, a 4-hour or a daily close below the 0.7340s opens near term risk to 0.7315.