GBP/USD Price Analysis: Bull cross and 50-HMA comes to the rescue ahead of UK data

- GBP/USD rebounds towards 1.3900 amid UK-India trades, risk reset.

- Bull cross and 50-HMA support fuels the renewed uptick in the spot.

- Hourly RSI holds bullish ahead of the UK and US macro updates.

GBP/USD is bouncing back towards the 1.3900 threshold amid a recovery in the risk sentiment, which seemingly caps the pullback in the US dollar.

A potential UK-India trade deal also lifts the sentiment around the pound. British Trade Minister Liz Truss said Tuesday, “we will start talks about a full free trade deal with India in the autumn.”

Traders now await the UK Final Manufacturing PMI and US Factory Orders data for fresh directives.

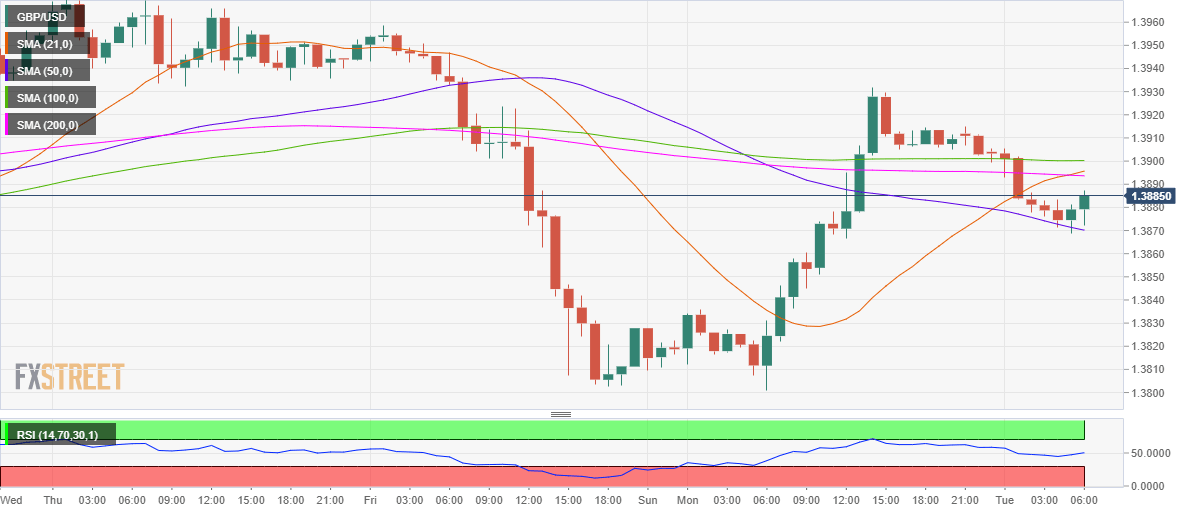

From a near-term technical perspective, the cable has held on to the 50-hourly moving average (HMA) at 1.3870 so far this Tuesday.

The abovementioned key support once again came to the rescue of GBP bulls, as the major sees a solid bounce.

The bull cross on the hourly chart, as represented by the 21-HMA cutting above the 200-HMA, adds credence to the renewed uptick alongside a bullish Relative Strength Index (RSI).

GBP/USD hourly chart

Immediate resistance awaits near 1.3895, the confluence of the 21 and 200-HMAs.

The horizontal 100-HMA at 1.3901 will guard the upside.

Alternatively, a fresh leg towards 1.3850 cannot be ruled out if the 50-HMA support caves in.

Monday’s low at 1.3831 will be next on the sellers’ radars.

GBP/USD additional levels to watch