GBP/JPY Price Analysis: Struggles for traction around mid-150.00s

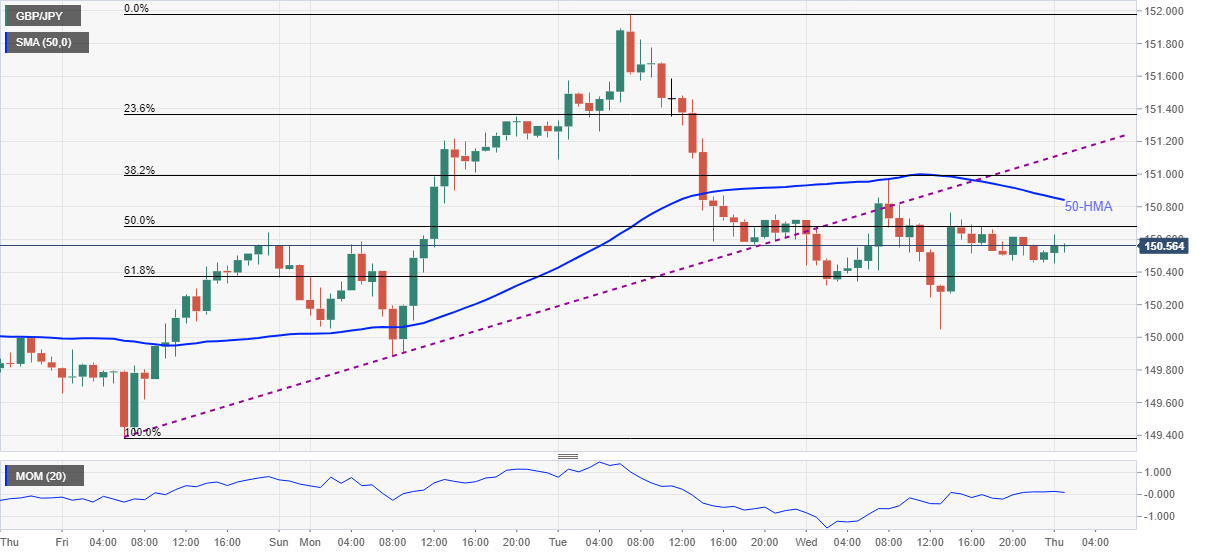

- GBP/JPY remains directionless below the key SMA and previous support line.

- Momentum indicator suggests further upside but bull should remain cautious below 151.15.

- Sellers can re-enter below 61.8% Fibonacci retracement level.

GBP/JPY seesaws around 150.50 during Thursday’s Asian session. In doing so, the quote fades the latest corrective pullback from the 150.00 threshold amid strong momentum signals.

However, 50-HMA and the previous support line from April 16, respectively around 150.85 and 151.15, seem to guard the quote’s recovery moves.

It should be noted that the quote’s run-up beyond 151.15 will aim for the weekly top near 152.00 and the March 18 peak surrounding 152.55.

Meanwhile, a downside break of 61.8% Fibonacci retracement of April 16-20 upside, near 150.35 will act as immediate support ahead of the 150.00 round figure.

In a case where GBP/JPY remains offered below 150.00, an ascending trend line from February 26 close to 149.70 will be the key to watch.

GBP/JPY hourly chart

Trend: Sideways