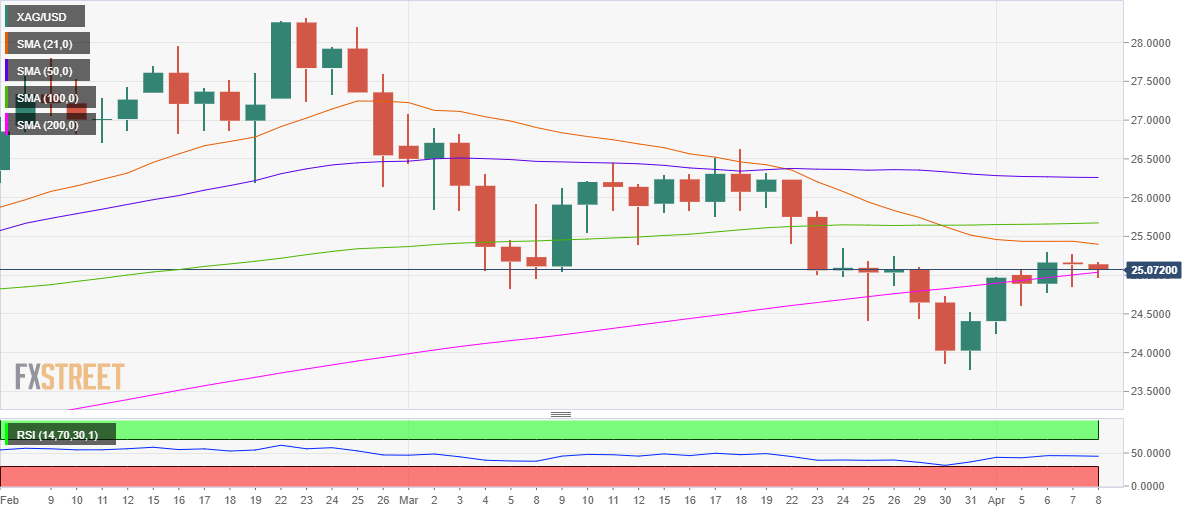

Silver Price Analysis: XAG/USD clinging onto 200-DMA support, downside favored

- Silver’s path of least resistance appears down, per the daily chart.

- Acceptance below 200-DMA support to trigger a fresh sell-off.

- RSI stays bearish, with 21-DMA acting as a strong upside hurdle.

Silver (XAG/USD) extends weakness into the second straight day on Thursday, as the critical 200-daily moving average (DMA) support at $25.03 is now put to test.

The white metal managed to close Wednesday above that level, although the upside break lacked conviction, as the sellers return on Thursday.

The 14-day Relative Strength Index (RSI) trades listless below the midline, the bearish territory, allowing room for declines.

The XAG bears are now looking for a strong foothold below 200-DMA, below which a steep drop towards the April 5 low of $24.61 cannot be ruled.

The psychological $24 mark could guard the downside towards the three-month lows of $23.78.

Silver Price Chart: Daily

However, if the bulls retain control above the abovementioned crucial support at $25.03, a bounce towards the horizontal 21-DMA, now at $25.40 can be seen.

The horizontal 100-DMA at $25.67 is a powerful hurdle for the bulls to crack.

Silver Additional levels