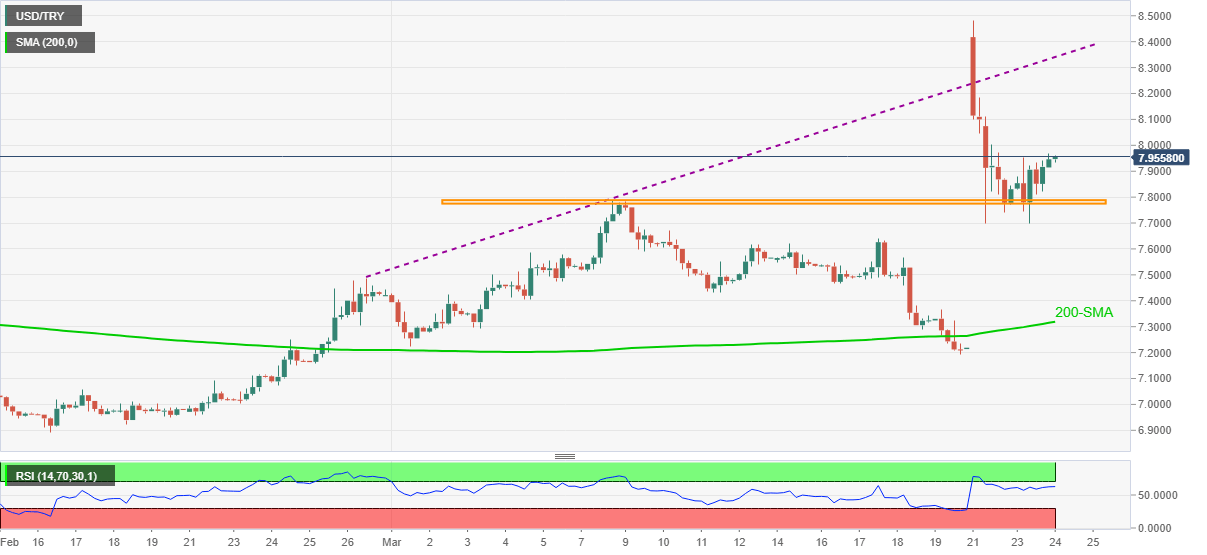

USD/TRY Price Analysis: Keeps early week bullish gap with eyes on 8.000 threshold

- USD/TRY stays on the front foot following the bounce off early March tops.

- Strong RSI and failures to slip beneath immediate support favor bulls.

- Monthly resistance line offers intermediate halts before the recent high, 200-SMA adds to the downside filters.

USD/TRY picks up bids around 7.9500, up 0.05%, during Wednesday’s Asian session. In doing so, the quote extends the previous day’s recovery moves from March 08 top while keeping the early-week gap to the north.

Considering the bullish RSI, USD/TRY is likely to cross the 8.0000 immediate hurdle while targeting 8.1000 round-figure during the further upside.

Though, an ascending trend line from February 26 and the recently-flashed multi-day top, respectively around 8.3370 and 8.4835 can test the bulls afterward.

Meanwhile, a downside break below 7.7750 will have to break the March 17 peak surrounding 7.6400 before directing USD/TRY sellers towards a 200-SMA level of 7.3193.

If at all the pair remains heavy past-7.3193, the monthly bottom around 7.1900 and the 7.000 psychological magnet will be the tough challenges for the bears.

USD/TRY four-hour chart

Trend: Bullish