USD/CAD Price Analysis: Bullish wedge breakout in play, OPEC+ decision/Powell’s speech awaited

- USD/CAD oscillated in a narrow trading range through the mid-European session.

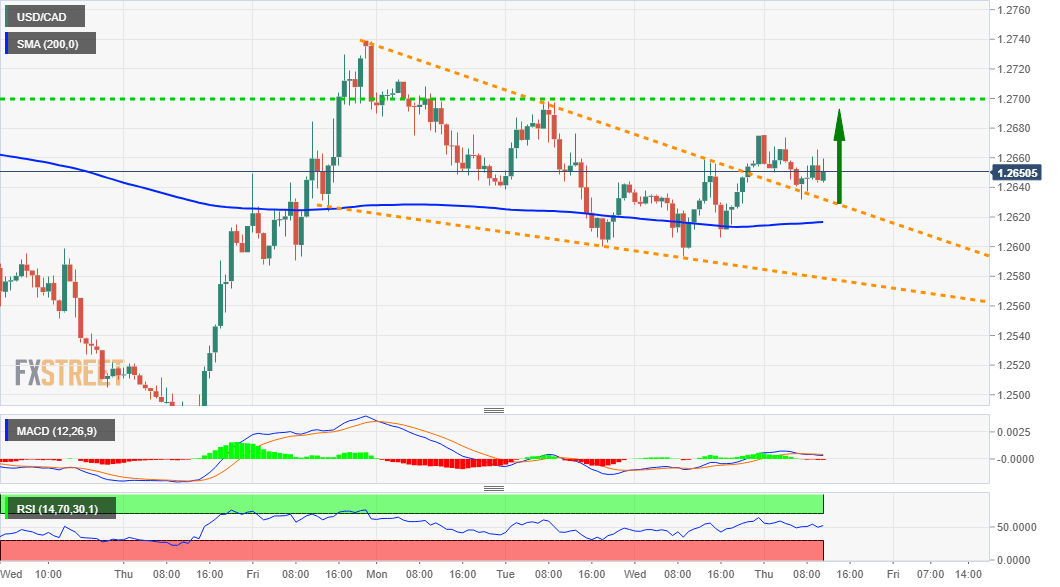

- A breakout through a falling wedge pattern supports prospects for additional gains.

- Bulls might aim for a move beyond the 1.2700 mark and test the 1.2745 supply zone.

The USD/CAD pair lacked any firm directional bias and seesawed between tepid gains/minor losses through the first half of the European session. The pair was last seen trading just above mid-1.2600s, nearly unchanged for the day.

Strong follow-through US dollar buying was seen as a key factor that assisted the USD/CAD pair to attract some dip-buying near the 1.2630 region. Apart from this, a modest pullback in crude oil prices undermined the commodity-linked loonie and remained supportive. That said, investors preferred to wait for Fed Chair Jerome Powell's scheduled speech later during the North American session. This, along with nervousness ahead of the OPEC+ decision on production quotas, further held traders from placing directional bets.

From a technical perspective, the intraday downtick managed to find decent support near a four-day-old descending trend-line resistance breakpoint. The mentioned resistance-turned-support constituted the formation of a bullish falling wedge on short-term charts. Given that the USD/CAD pair, so far, has managed to find acceptance above the pattern resistance, the intraday bias seems tilted in favour of bullish traders. Hence, a move back towards weekly tops, around the 1.2700 mark, looks a distinct possibility.

Meanwhile, technical indicators on the daily chart have recovered from the negative territory and maintained their bullish bias on hourly charts. This, in turn, further supports prospects for an extension of the recent goodish bounce from multi-year lows. A sustained strength beyond the 1.2700 mark will reaffirm the constructive outlook and push the USD/CAD pair back towards the 1.2745 supply zone. Some follow-through buying should pave the way for a move towards reclaiming the 1.2800 round-figure mark.

On the flip side, the 1.2630 region might continue to protect the immediate downside. This is followed by the lower boundary of the wedge, around the 1.2600-1.2590 region, which if broken decisively will negate any near-term bullish bias. The USD/CAD pair might then turn vulnerable and accelerate the fall further towards challenging the key 1.2500 psychological mark.

USD/CAD 1-hourly chart

Technical levels to watch