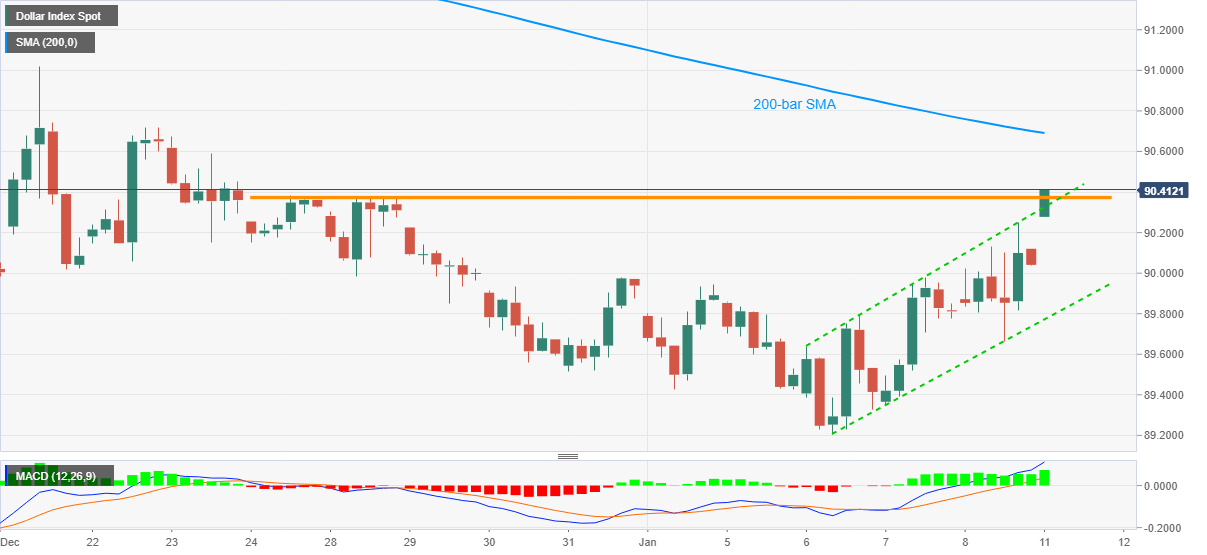

US Dollar Index Price Analysis: DXY refreshes two-week high, bulls eye 200-bar SMA

- DXY takes the bids near multi-day high after crossing immediate horizontal resistance.

- Bullish MACD, risk-off mood favor further upside to the key SMA.

- Sellers should wait for a downside break of short-term rising channel.

US dollar index (DXY) stays on the front foot around 90.38, up 0.38% intraday, during Monday's Asian session. In doing so, the greenback gauge jumps above the resistance line of an upward slopping trend channel to refresh the highest levels last seen during December 24.

While bullish MACD and break of a fortnight peak favor the quote’s further upside, risk aversion wave, mainly due to the coronavirus (COVID-19) fears and the US-China tension, also propel the US dollar’s safe-haven demand.

That said, buyers need a clear break above the latest high near 9.40 to challenge the 200-bar SMA level of 90.70.

However, the late-December high surrounding 91.00 will be a tough nut to crack for the DXY bulls afterward.

Alternatively, the stated channel’s resistance line, at 90.30 now, holds the key to the gauge’s fresh downside targeting December 31 top close to the 90.00 threshold.

In a case where the DXY sellers dominate past-90.00, the support line of the stated channel, at 89.75 now, will be the key to watch.

DXY four-hour chart

Trend: Further upside expected