Back

22 Jul 2020

EUR/GBP Price Analysis: RSI OB, bullish reverse H&S in the making

- EUR/GBP is trading within critical structural areas throughout the time frames.

- The price is trading with an immediate bearish bias while longer-term setups apply on hold of structure.

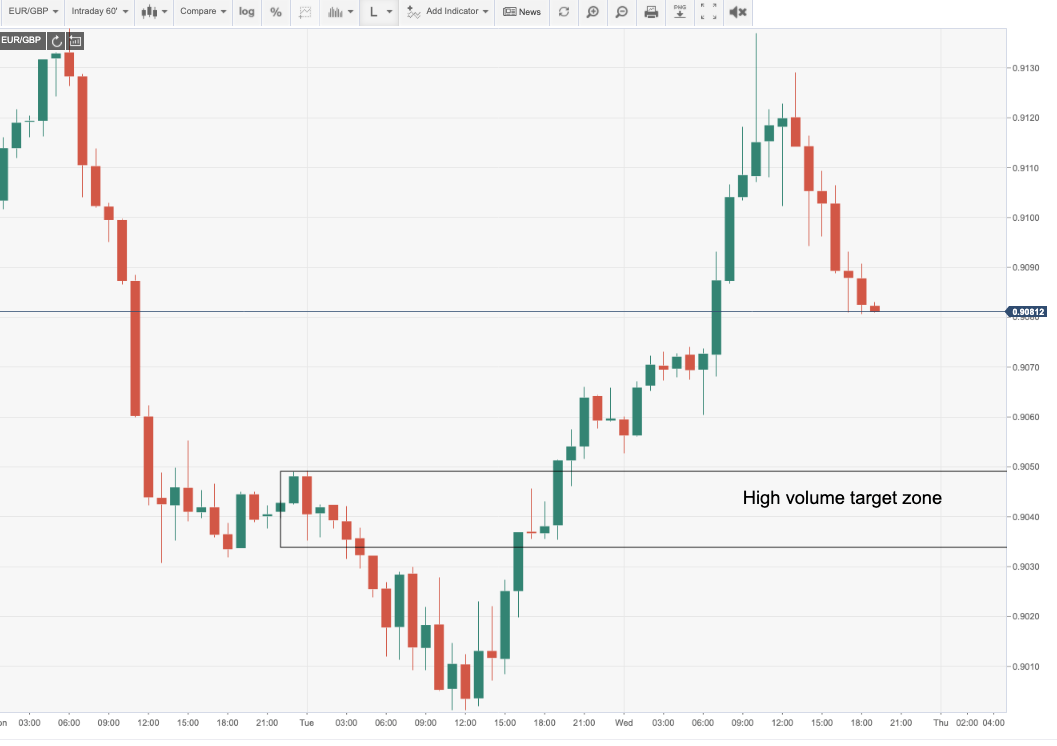

- Bears look to high volume zone at 0.9038/50 in the meantime.

The following is a top-down analysis from monthly to the 4Hr charts which have seen a bearish correction and RSI moving from overbought (OB) territory.

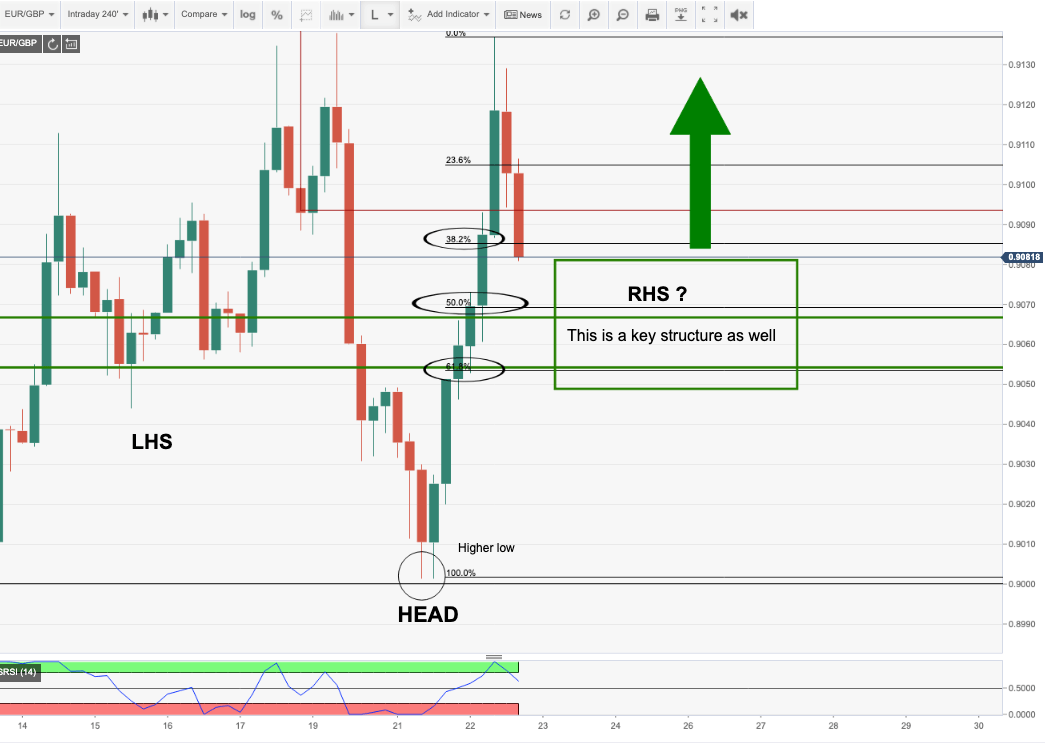

There are prospects for the completion of a bullish reverse head and shoulders pattern to fit the upside narrative from a longer-term technical analysis as follows:

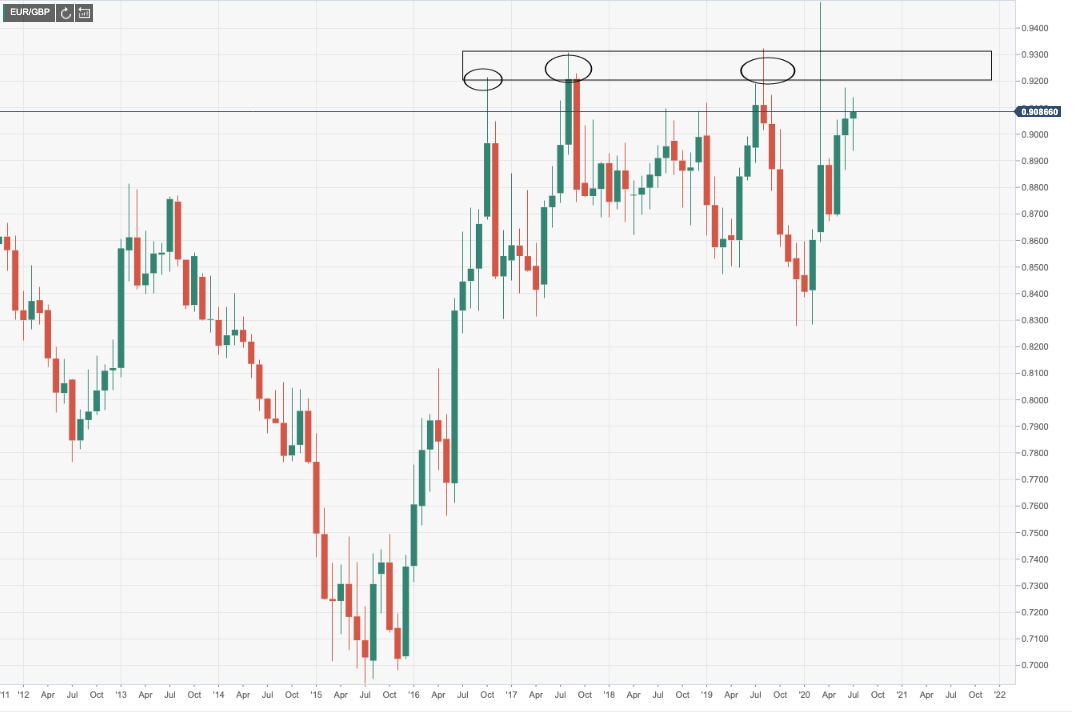

Bulls target strong monthly resistance

5-wave analysis is bullish

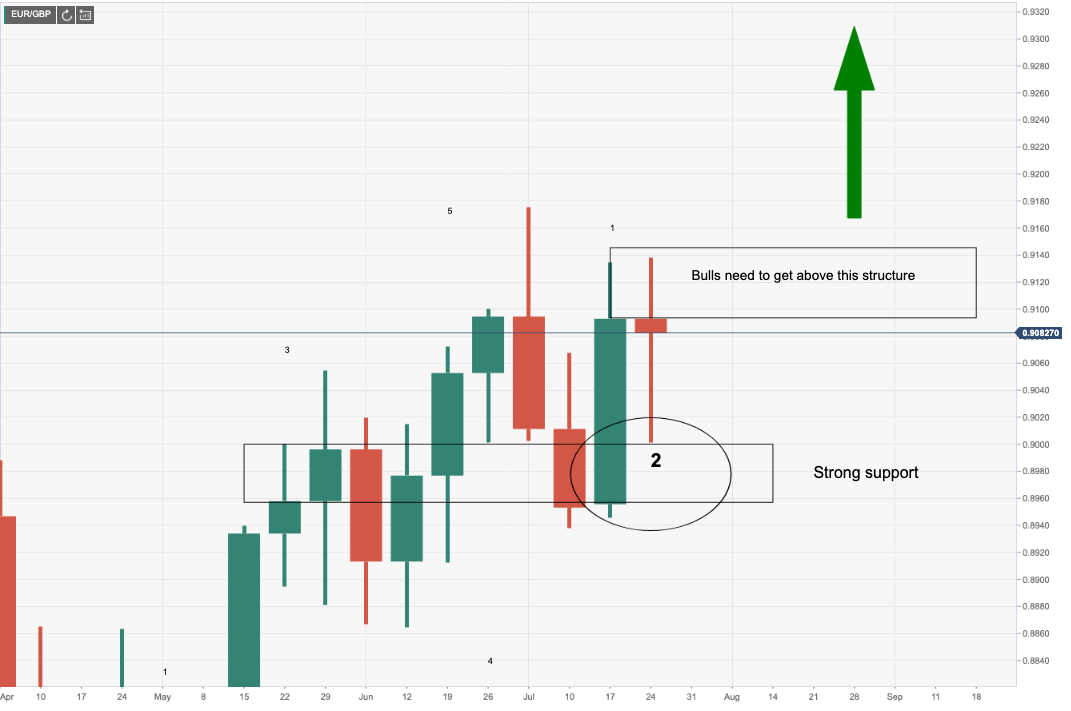

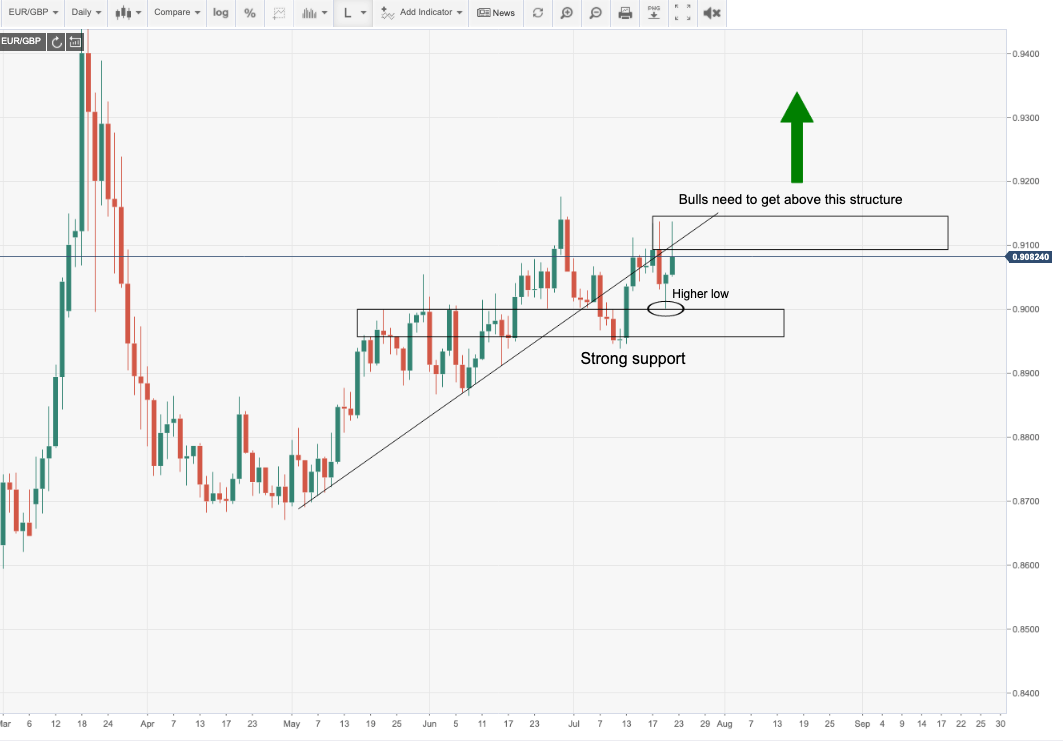

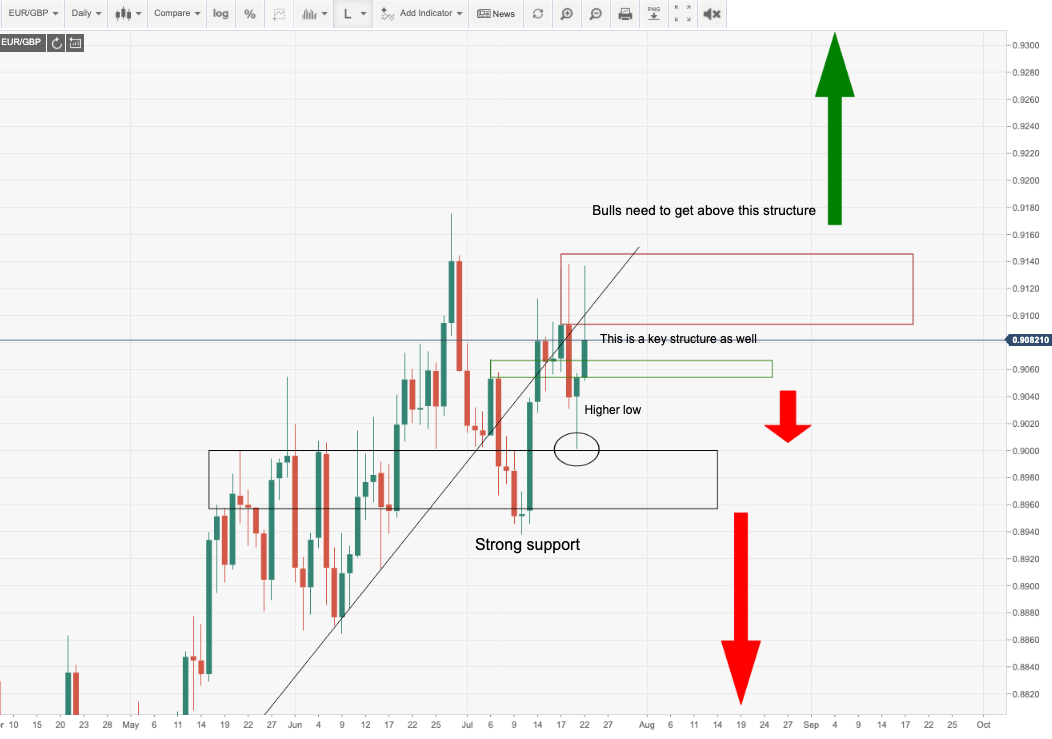

Still work to be done by the bulls, leaning on strong support/bullish price action

The trend-line is menacing, still higher lows are favourable

Daily structures and price-flow prospects

4-HR Reverse Head & Shoulders taking shape as RSI moves out of OB territory

The conclusion to the analysis is that the price is likely stuck in a barroom brawl of consolidation for some time to come at this juncture.

Breakouts of the range are required for a convincing swing-trade set-up.

From a volume profile, price is leaving high volume levels for the week's range so far.

A break of 0.9080 opens risk to 0.9060/38 high volume targets on the hourly chart: