Back

13 Jul 2020

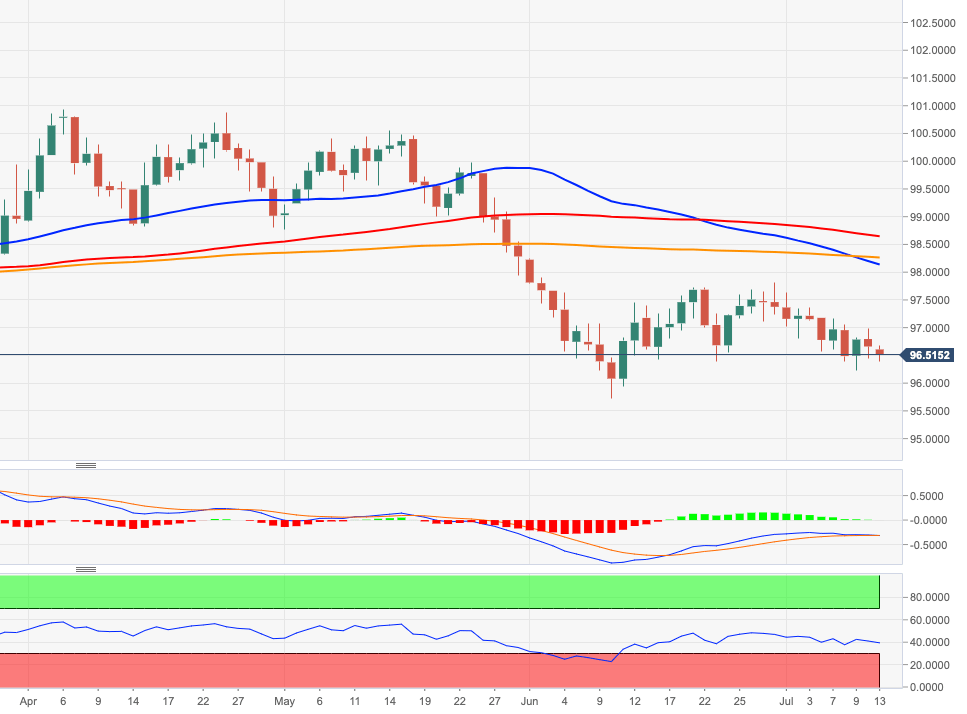

US Dollar Index Price Analysis: Extra downside looks likely

- DXY remains under pressure amidst prevailing risk-on trends.

- Further declines now expose the Fibo level in the 96.00 zone.

DXY is extending the leg lower following Friday’s failure to break above the key barrier at 97.00 the figure.

The continuation of the decline is seen testing the Fibo level (of the 2017-2018 drop) just above 96.00 ahead of June’s low at 95.71.

The negative outlook on the dollar is expected to remain unaltered while below the 200-day SMA, today at 98.25.

DXY daily chart