When are the UK jobs and how could they affect GBP/USD?

UK Jobs report overview

Early Tuesday, the UK’s Office for National Statistics (ONS) will release the May month Claimant Count figures together with the Unemployment Rate in the three months to April at 06:00 AM GMT. Given the data collection period covers the return of the activities from the coronavirus (COVID-19)-led lockdown, today’s data becomes the key for the Cable traders to watch.

The UK labor market report is expected to show that the average weekly earnings, including bonuses, in the three months to March, might consolidate from the previous 2.4% to 1.4%, while ex-bonuses, the wages are also seen declining to 1.9% from 2.7% in the reported period.

The number of people seeking jobless benefits, namely the Claimant Count Change, is likely to soften by 370K in May versus +865.5K seen last. Further, the ILO unemployment rate is expected to pick up from 3.9% to 4.5% during the three months ending in April

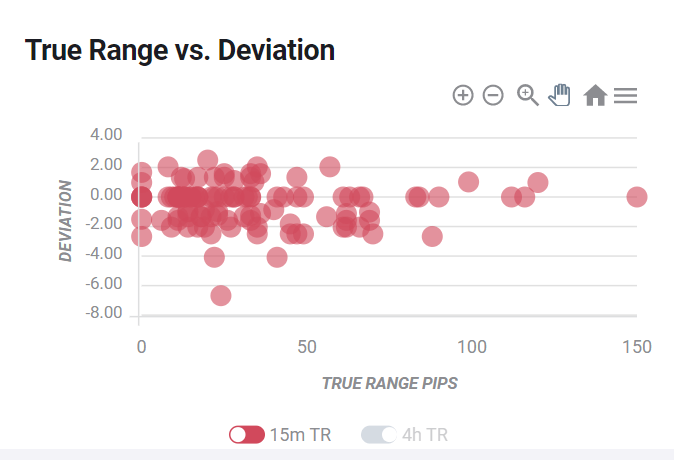

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

.

How could they affect GBP/USD?

While extending Monday’s recovery moves, GBP/USD takes bids near 1.2670 while heading into the London open on Tuesday. Even if the fears of the Brexit as well as lack of major positives looms over the UK economy, the broad US dollar weakness seems to favor the pair’s latest up-moves before the British employment data.

Yohay Elam, Analyst at FXStreet explains, “a significant move in pound/dollar depends on a clear message from the data. If claims rise less than expected – fewer than 300,000 for example – and wages hold up and don't fall by a full percentage point, sterling has room to rise. It would paint a more optimistic picture of both April and May.”

On the other hand, a leap of over 400,000 jobless applications and salary rises grinding down to 1% would already serve as a one-two-punch for the pound.

Technically, 200-day SMA around 1.2965 could aptly challenge the pair’s recovery moves from a 21-day SMA level of 1.2470. Even so, the bulls remain hopeful unless breaking an ascending trend line from March 20, at 1.2405 now.

Key notes

UK Jobs Preview: Fewer unemployment claims or slower wage rises, which will stir sterling?

GBP/USD Forecast: Lifted by broad dollar’s weakness

About UK jobs

The UK Average Earnings released by the Office for National Statistics (ONS) is a key short-term indicator of how levels of pay are changing within the UK economy. Generally speaking, the positive earnings growth anticipates positive (or bullish) for the GBP, whereas a low reading is seen as negative (or bearish).