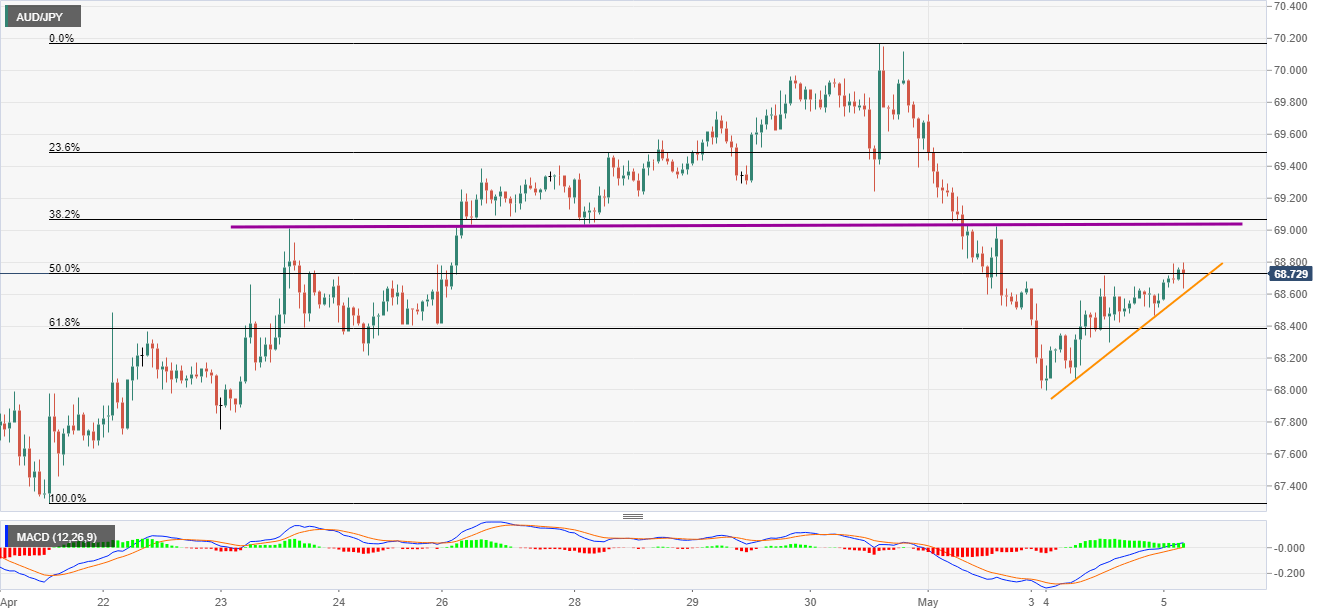

AUD/JPY Price Analysis: Pulls back from 50% Fibonacci retracement after RBA

- AUD/JPY steps back from the two-day top.

- RBA announced no monetary policy change, downgraded economic forecasts.

- The weekly support trend line, 61.8% Fibonacci retracement in focus.

The RBA’s downbeat forecasts dragged AUD/JPY down from 68.80 to 68.68 by the press time of early Tuesday. Though, the pair is still up 0.13% on a day while also staying above the short-term support line.

Also read: RBA: Will not increase the cash rate target until inflation, employment goals are met

As a result, sellers will look for entry below 68.60 support line to revisit 61.8% Fibonacci retracement of April 21-30 upside, near 68.38.

Given the pair’s sustained declines past-68.38, Monday’s low near 68.00 will lure the sellers.

On the contrary, a sustained break of 50% Fibonacci retracement, at 68.73, will again aim to confront eight-day-old horizontal resistance around 69.05.

It should also be noted that the pair’s successful rise past-69.05 enables the buyers to aim for 70.00 and the previous month top surrounding 70.15.

AUD/JPY hourly chart

Trend: Pullback expected