Back

31 Mar 2020

Crude Oil Futures: Deeper retracement on the cards

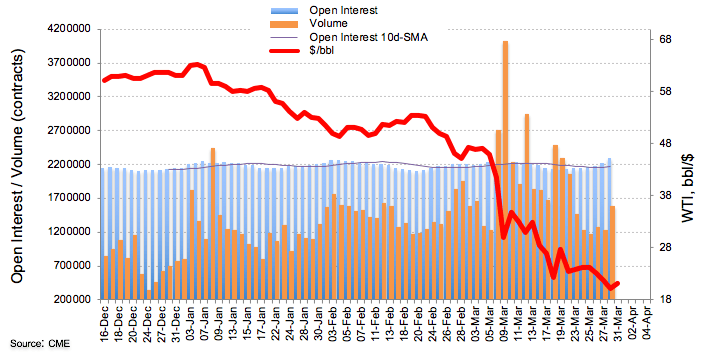

Open interest in Crude Oil futures increased by around 71.4K contracts on Monday, the largest single-day build so far this year according to advanced readings from CME Group. In the same line, volume went up by nearly 353.8K contracts, the highest level since March 18th.

WTI: Rallies seen as selling opportunities

Prices of the WTI dropped to fresh 17-year lows near $19.20 per barrel at the beginning of the week and closed the session just above the key $20.00 mark. Rising open interest and volume amidst the current negative price action favour further near-term pullbacks, although it is worth mentioning that the extreme oversold conditions of the commodity could spark eventual bouts of strength. These, however, could be deemed as selling opportunities for the time being.