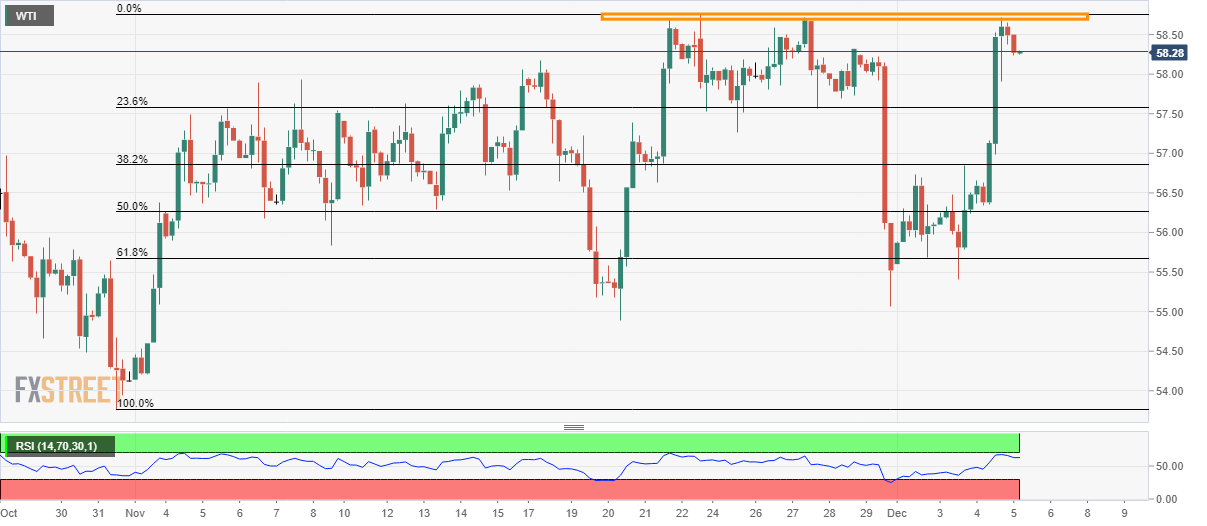

WTI Technical Analysis: Sellers keep lurking around $58.70/80

- WTI pulls back from one week high.

- An upside break could recall late-September tops.

- 23.6% Fibonacci retracement seems to be the next on sellers radar.

WTI declines $58.30 while heading into the European open on Thursday. With this, the black gold repeats the pattern of pulling back from $58.70/80 as marked in the previous month.

As a result, sellers can take aim at 23.6% Fibonacci retracement level of October-November rise, at $57.55, ahead of looking at the month-start top near $56.70.

If prices keep it below $56.70, 61.8% Fibonacci retracement and November 20 low, close to $55.70 and $54.90 respectively, can please the bears.

Alternatively, an upside clearance of $58.80 will need validation from $59.00 while challenging September 19 high around $59.45.

Additionally, $60.00 will be the key to watch beyond $59.45 as it holds the gate to the energy benchmark’s rise to September month top surrounding $63.13.

WTI four-hour chart

Trend: Pullback expected