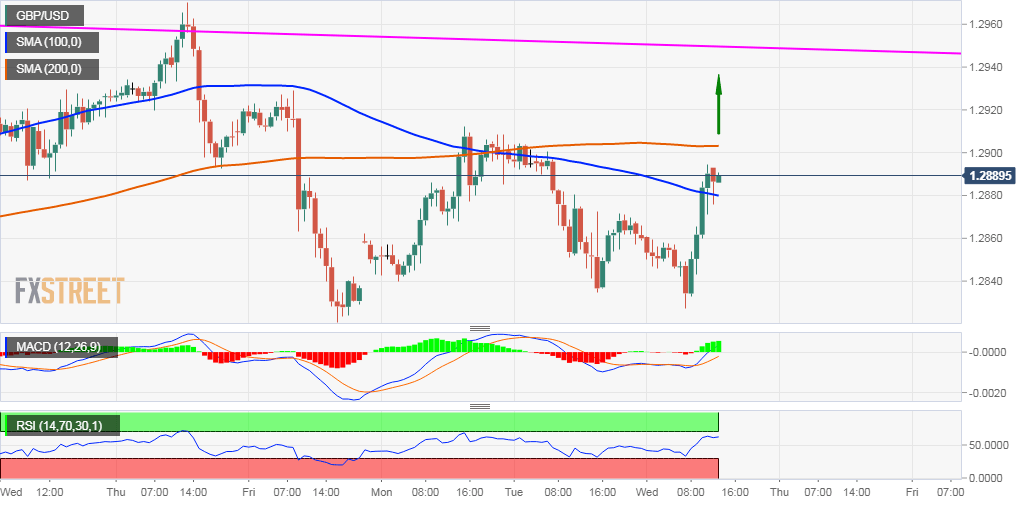

GBP/USD Technical Analysis: Clings to intraday gains, just below 200-hour SMA ahead of US data

- The GBP/USD pair quickly reverses an early dip to weekly lows.

- Move beyond the 1.2900 handle to pave way for further gains.

The GBP/USD pair built on its goodish intraday bounce from weekly lows and is currently placed near the top end of its daily trading range, just below the 1.2900 round figure mark.

The mentioned handle coincides with 200-hour SMA, which if cleared decisively might be seen as a key trigger for bullish traders and set the stage for a further intraday appreciating move.

Meanwhile, technical indicators on the daily chart maintained their bullish bias and have again started gaining positive traction on hourly charts, adding credence to the constructive outlook.

Hence, some follow-through buying has the potential to lift the pair further towards challenging a resistance marked by the top end of over one-month-old descending channel, around mid-1.2900s.

On the flip side, daily swing lows around the 1.2825 region, also tested last Friday, now seems to have emerged as immediate strong support, which if broken might prompt some aggressive selling.

The pair then might turn vulnerable to accelerate the slide further below the 1.2800 handle towards challenging the trend-channel support, currently near the 1.2735-30 region.

GBP/USD 1-hourly chart