Back

27 Sep 2019

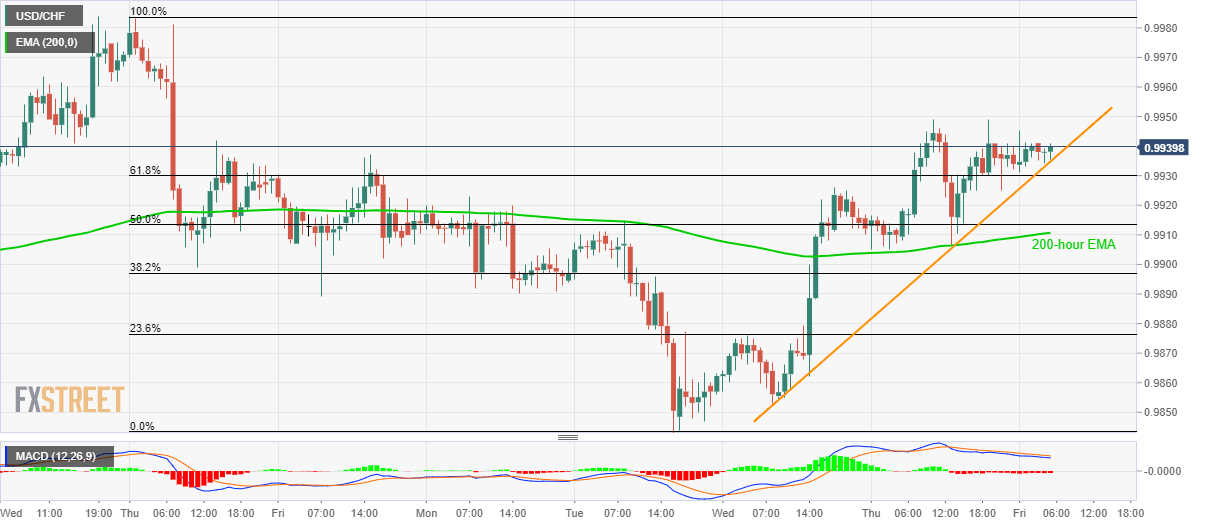

USD/CHF technical analysis: Bullish exhaustion around 2-day-old support-line

- USD/CHF seems to lose upside strength.

- Bearish MACD portrays the momentum weakness above 61.8% Fibonacci retracement and two-day-old rising trend-line.

USD/CHF has been under pressure off-late while taking rounds to 0.9940 ahead of the European session on Friday.

The pair stays above two-day-old rising trend-line and 61.8% Fibonacci retracement but fails to rise above 0.9950. Also portraying the pair’s weakness is a bearish signal by the 12-bar moving average convergence and divergence (MACD) indicator.

As a result, chances of the pair’s drop to 200-hour exponential moving average (EMA) level of 0.9910 seem brighter once prices drop below 0.9930 support-line.

On the contrary, an upside clearance of 0.9950 enables buyers to challenge 0.9985 while also expecting 1.0000 during further advances.

USD/CHF hourly chart

Trend: pullback expected