Back

30 Apr 2019

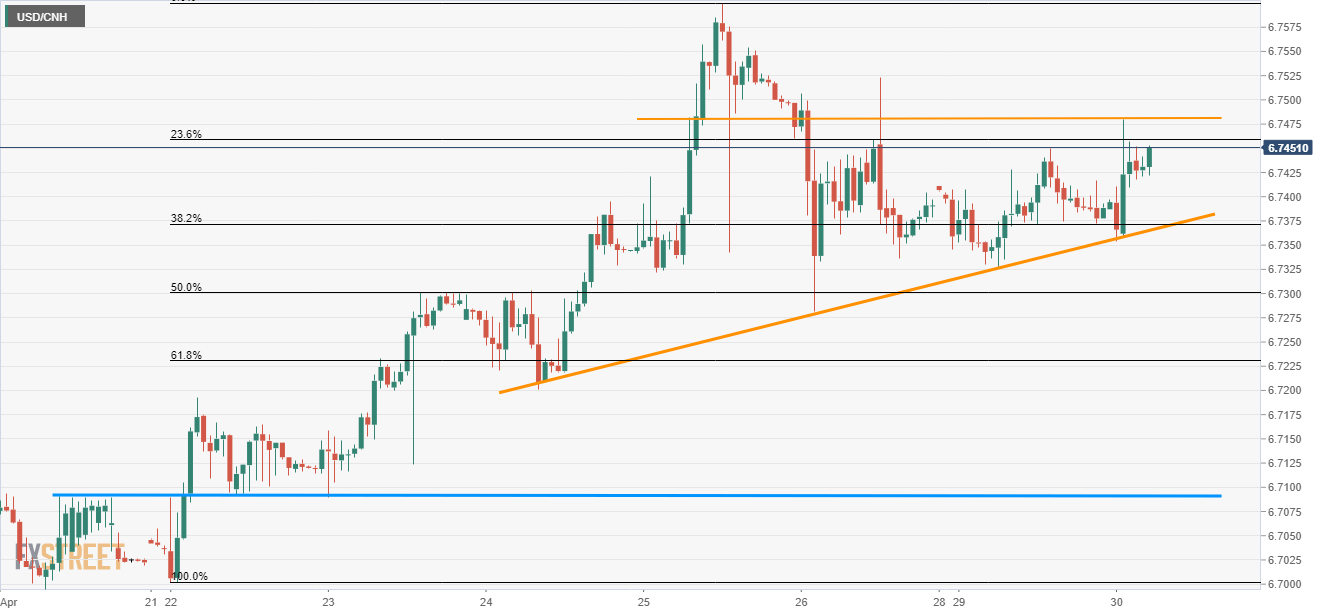

USD/CNH technical analysis: Sellers keep lurking around 6.7480/85

- Immediate horizontal resistance restricts the immediate upside.

- A week-long ascending support-line is at play near 6.7370.

Following its failure to cross a horizontal-line since April 25, USD/CNH is trading near 6.7430 ahead of the European open on Tuesday.

Even if the pair falls short of clearing 6.7480/85 resistance, a week-long ascending trend-line at 6.7370 restricts its immediate downside, a break of which highlights 50% Fibonacci retracement of its latest up-moves from April 22, at 6.7300.

Should there be increased selling pressure under 6.7300, 61.8% Fibonacci retracement near 6.7230 and 6.7200 may offer intermediate halts during the downside to 6.7160 and 6.7100 rest-points.

Meanwhile, an upside clearance of 6.7485 enables buyers to cross 6.7500 round-figure and aim for the latest high near 6.7600.

USD/CNH hourly chart

Trend: Pullback expected