EUR/USD stays depressed near 1.1450 post-EM data

- The pair meets fresh lows in the boundaries of 1.1450.

- The greenback pushes higher and approaches 95.70.

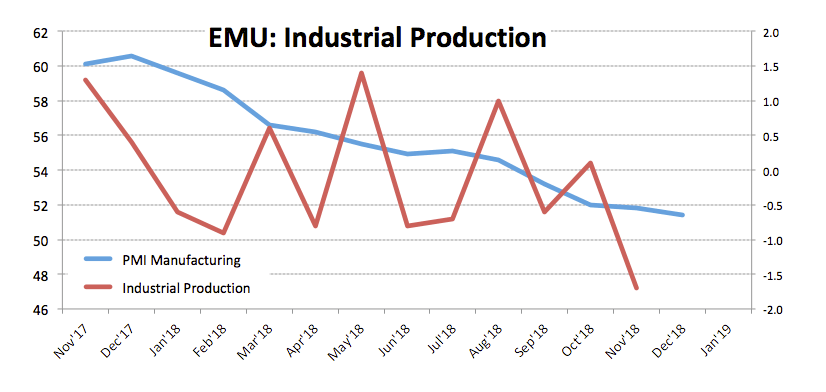

- EMU’s Industrial Production plummeted in November.

The demand for the European currency remains depressed on Monday and is now forcing EUR/USD to drop and test fresh lows in the mid-1.1400s.

EUR/USD offered post-data

Spot met further selling pressure after Industrial Production in the euro area unexpectedly contracted at a monthly 1.7% during November and 3.3% from a year earlier.

On the other hand, the greenback keeps the bid tone around 95.70 and is looking to add to gains recorded in the second half of last week, all amidst lack of headlines in the US-China trade front and the continuation of the partial US shutdown.

What to look for around EUR/USD

Today’s weaker-than-expected Industrial Production figures in the euro bloc during November reinforced the view of a poor performance of the economy in the region during the second half of 2018. In this regard, the ECB ‘data-dependency’ is expected to grow in significance along with a potential turn to a more ‘flexible’ stance in monetary conditions as a consequence of the apparent slowdown in the region’s fundamentals, all rendering in less support for occasional bullish attempts in spot.

EUR/USD levels to watch

At the moment, the pair is losing 0.04% at 1.1462 and a breakdown of 1.1447 (10-day SMA) would target 1.1411 (21-day SMA) en route to 1.1306 (2019 low Jan.3). On the upside, the next hurdle emerges at 1.1569 (2019 high Jan.10) seconded by 1.1585 (61.8% Fibo of the September-November drop) and finally 1.1621 (high Oct.16 2018).