US Dollar Index sidelined around 95.60, looks to trade, data

- The index looks for direction in the 95.60 region so far.

- Yields of the US 10-year note opened below 2.68% today.

- US Producer Prices, Philly index next on tap on Tuesday.

The greenback, in terms of the US Dollar Index (DXY), is posting small losses at the beginning of the week around the 95.60 zone.

US Dollar Index supported near 95.00

The index is showing some signs of weakness on Monday following two consecutive daily gains, with support so far emerging at YTD lows in the boundaries of 95.00 the figure. This area of contention appears also reinforced by the critical 200-day SMA near 94.90.

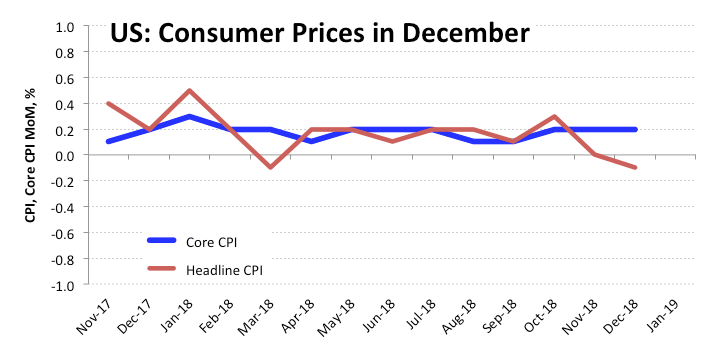

The greenback keeps looking to the broad risk-appetite trends for direction, while market participants continue to adjust to Friday’s inflation figures for the month of December, which came in in line with previous estimates.

Nothing scheduled today in the US calendar, with December’s Producer Prices and the key Philly Fed index expected tomorrow.

What to look for around USD

Progress (or the lack of it) in the ongoing US-China trade talks remains one of the main drivers for the buck’s price action in the near term via its impact on the broader risk trends. Meanwhile, investors continue to gauge the potential re-pricing of the rate path by the Federal Reserve for the next months along with the health of the US economy, all particularly exacerbated after the recent FOMC minutes, dovish comments from Fed-speakers and the renewed ‘patient and flexible’ stance from the Fed.

US Dollar Index relevant levels

At the moment, the pair is losing 0.07% at 95.60 and a breakdown of 95.03 (2019 low Jan.10) would open the door to 94.91 (200-day SMA) and finally 94.79 (low Oct.16 2018). On the upside, the next hurdle arises at 95.87 (10-day SMA) seconded by 96.30 (21-day SMA) and then 96.96 (2019 high Jan.2).