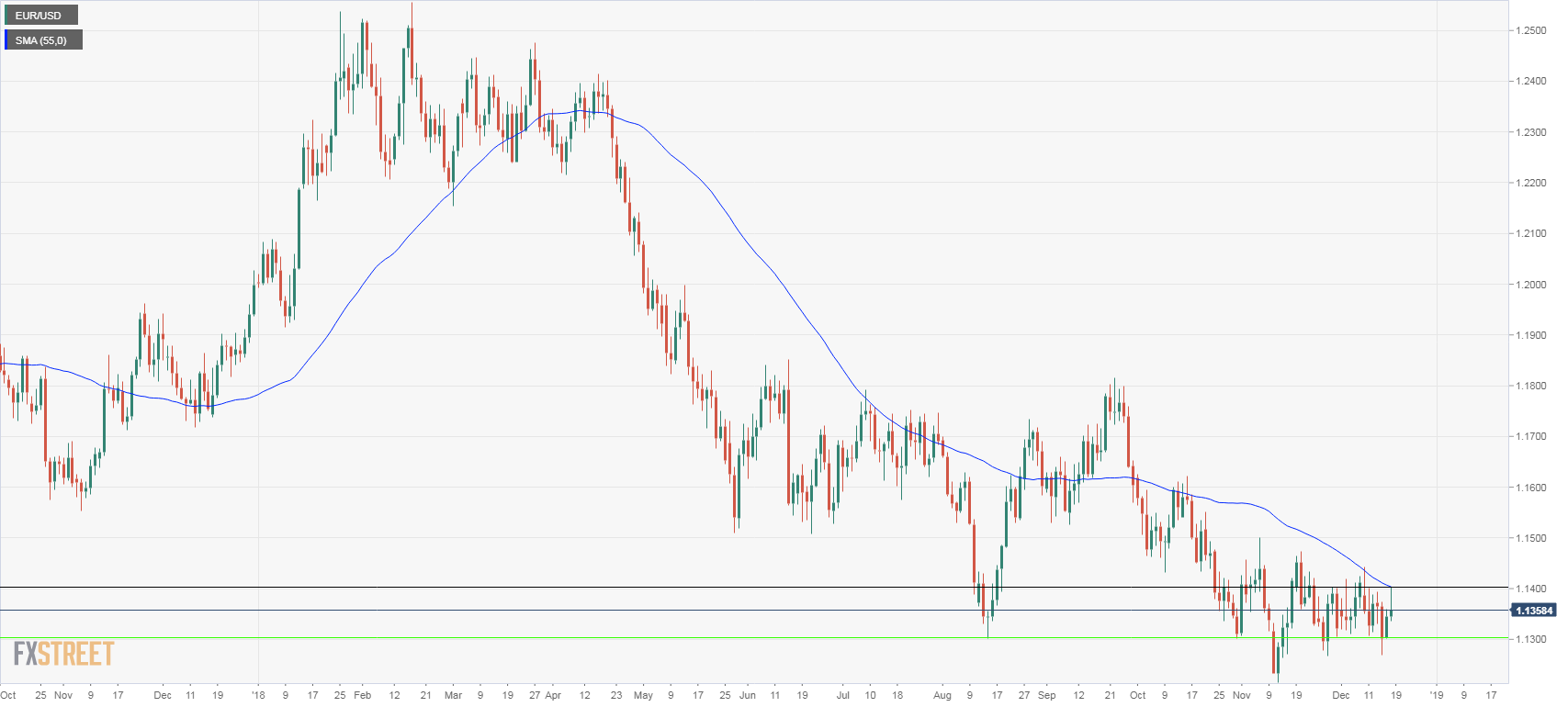

EUR/USD Technical Analysis: Range prevails with a slight bias to the downside

- The euro failed to break above 1.1400 and pulled back. Ahead of the Fed’s decision, the pair continues to move sideways.

- The EUR/USD remains in a range between 1.1300 and 1.1400, moving without a clear bias, with the dominant trend still pointing to the downside. A daily close above 1.1400, also the 55-day moving average, would open the doors for a test of the strong resistance levels seen at 1.1450. It the euro manages to consolidate on top, a rally to test 1.1520 seems likely.

- A daily close significantly below 1.1300 would add to the negative tone, exposing 1.1260/70 first and below YTD lows at 1.1215/20.

EUR/USD Daily Chart

EUR/USD

Overview:

Today Last Price: 1.1356

Today Daily change: 10 pips

Today Daily change %: 0.0881%

Today Daily Open: 1.1346

Trends:

Previous Daily SMA20: 1.1354

Previous Daily SMA50: 1.1396

Previous Daily SMA100: 1.1494

Previous Daily SMA200: 1.1712

Levels:

Previous Daily High: 1.136

Previous Daily Low: 1.1302

Previous Weekly High: 1.1444

Previous Weekly Low: 1.1269

Previous Monthly High: 1.15

Previous Monthly Low: 1.1216

Previous Daily Fibonacci 38.2%: 1.1337

Previous Daily Fibonacci 61.8%: 1.1324

Previous Daily Pivot Point S1: 1.1312

Previous Daily Pivot Point S2: 1.1278

Previous Daily Pivot Point S3: 1.1254

Previous Daily Pivot Point R1: 1.1369

Previous Daily Pivot Point R2: 1.1393

Previous Daily Pivot Point R3: 1.1427