Back

11 Sep 2018

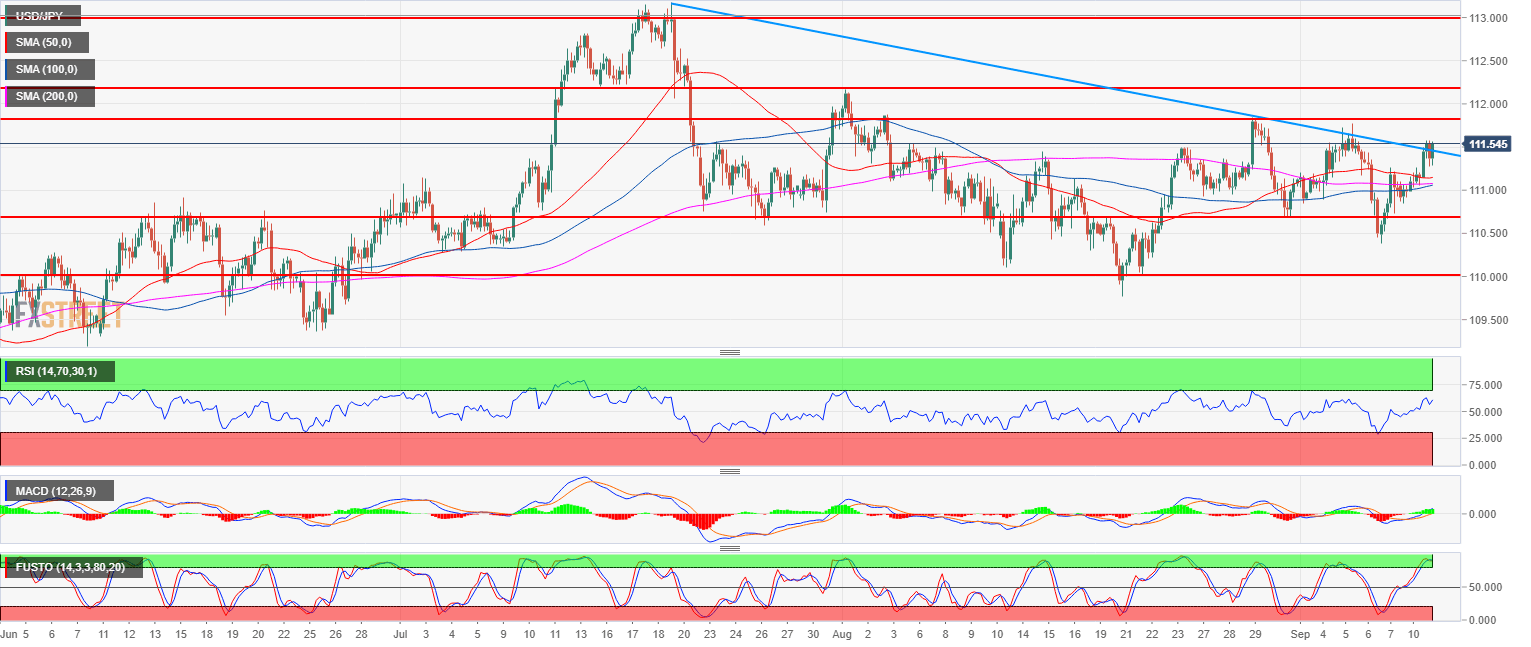

USD/JPY Technical Analysis: Bulls eager to break above 112.00 figure

- USD/JPY main bull trend is taking a breather since mid-July as the market has entered a trading range.

- USD/JPY bulls are trying to break above the bear trendline from July 17 but they will also have to break above the 112.00-112.17 zone (figure and August 1, swing high) if they wish to resume the bull trend. The RSI, MACD and Stochastics indicators remain constructive to the upside.

- However, the 50, 100 and 200-period simple moving averages are flat suggesting that there is not yet convincing momentum in the market.

USD/JPY 4-hour chart

Spot rate: 111.53

Relative change: 0.38%

High: 111.58

Low: 110.05

Main trend: Bullish

Short-term trend: Neutral

Resistance 1: 111.54 August 6, high

Resistance 2: 111.84 August 29 swing high

Resistance 3: 112.00-112.17 zone, figure and August 1, swing high

Resistance 4: 112.40 supply level

Resistance 5: 113.18, 2018 high

Support 1: 111.45 August 8 high

Support 2: 111.00 figure

Support 3: 110.75, July 23 swing low

Support 4: 110.00 figure

Support 5: 109.37 June 25 low