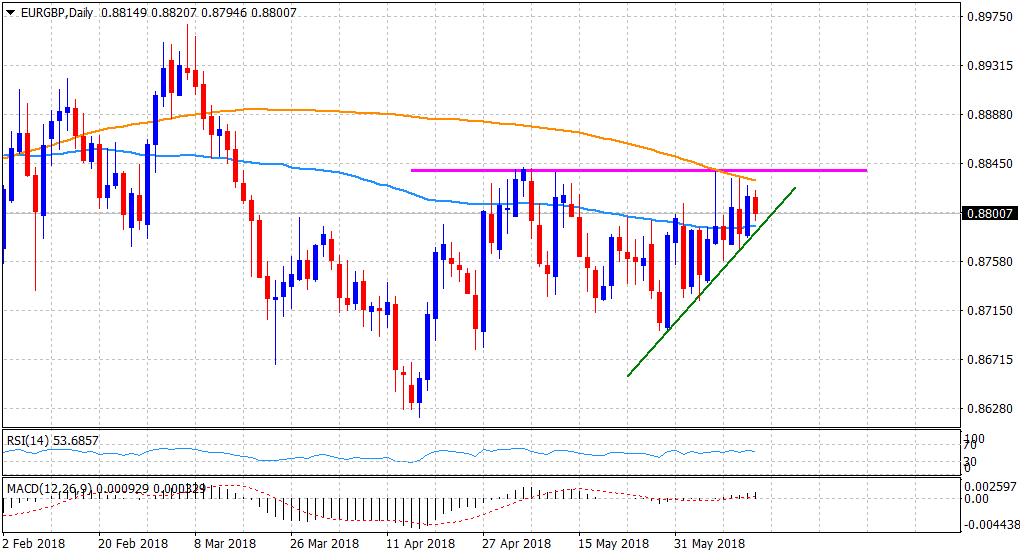

EUR/GBP Technical Analysis: struggle to conquer 200-DMA barrier continues

• The cross continued with its struggle to make it through the very important 200-day SMA, with upbeat UK monthly retail sales data prompting some fresh selling.

• A follow-through weakness below a confluence support would negate prospects for any near-term up-move and pave the way for further downside.

• Neutral technical indicators have failed to confirm any firm directional bias and hence, it would be prudent to wait for a decisive break before positioning for near-term trajectory.

EUR/GBP daily chart

Spot Rate: 0.8800

Daily High: 0.8821

Daily Low: 0.8795

Trend: Indecisive

Resistance

R1: 0.8842 (May 4 swing high)

R2: 0.8884 (R3 daily pivot point)

R3: 0.8900 (round figure mark)

Support

S1: 0.8789 (100-day SMA)

S2: 0.8760 (S2 daily pivot-point)

S3: 0.8724 (monthly low set on June 5)