USD/JPY: positive tone before FOMC minutes

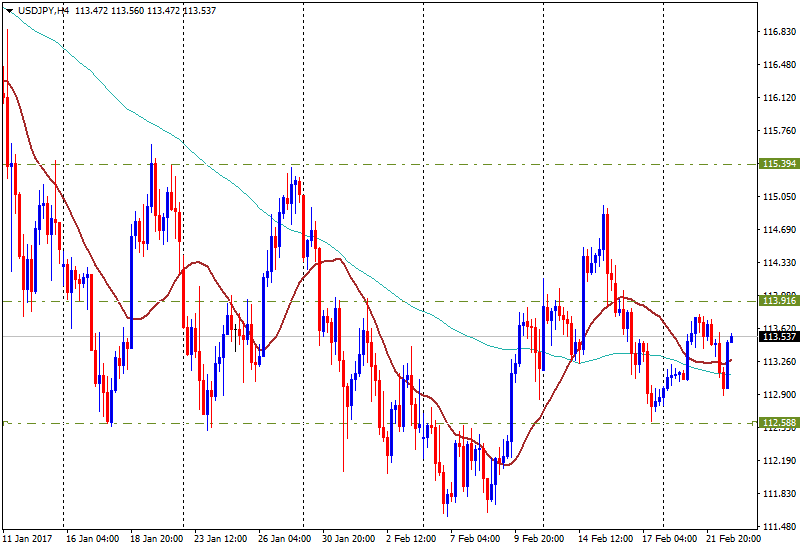

USD/JPY has been rising since the beginning of the American session and erased most of the day’s losses. The pair bottomed at 112.89 and then bounced quickly back above 113.00. Currently it trades at 113.50/55, 15 pips below yesterday’s closing price.

In a few minutes, the FOMC minutes from the latest meeting will be release. Traders will look into the minutes for signals about how the actual tightening cycle could continue. A hawkish message could send US bond yields to the upside and weaken the yen in the market while if market participants take the minutes as dovish, the US dollar could fell.

Levels to watch

Price action still remains within last week trading range. The upside has been losing strength below 114.00. On the downside, the pair today and on Monday was rejected from below 113.00.

A break and a consolidation significantly above 114.00 could open the doors for a test of last week highs near 115.00. While on the downside, a decline under 113.25 could add short-term momentum to the yen. The key level to break for the pair to the downside could be seen around 112.50/60.