USD/CAD targeting 100-DMA near 1.3280; Retail Sales 'worse than expected' at -0.5%

Currently, USD/CAD is trading at 1.3195, up +0.42% or 56-pips on the day, having posted a daily high at 1.3209 and low at 1.3110.

Today's CAD economic docket had traders and investors waiting for Retailes Sales (MoM) and Retail Sales ex Autos (MoM) readings to allocate or dilute portfolio positions. However, both releases failed to deliver positive figures as RS clocked (0.5%) below 0.0% consensus and previous 0.3%, also RS ex Autos printed a negative result at (0.3%) below 0.6% consensus and previous (0.1%). As expected, the Loonie lost ground against the American dollar as the pair now challenges the 50-DMA.

Historical data available for traders and investors indicates during the last 8-weeks that USD/CAD pair, a commodity-linked currency, had the best trading day at +1.71% (Jan.18) or 227-pips, and the worst at -1.02% (Jan.17) or (133)-pips.

Technical levels to watch

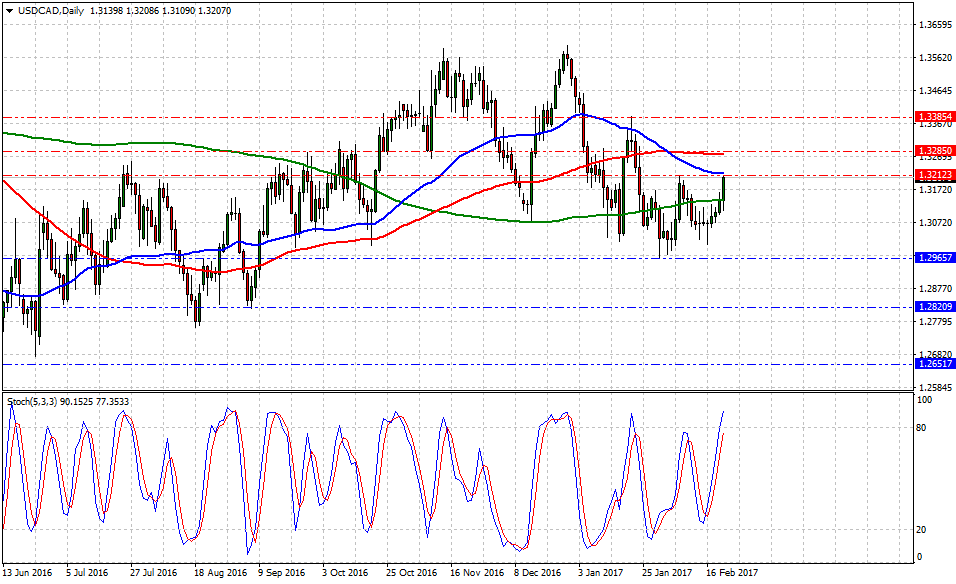

In terms of technical levels, upside barriers are aligned at 1.3211 (high Feb.7), then at 1.3280 (100-DMA) which seems to build a 'Walls of Troy' multi-year resistance region since July 2015 and finally above that at 1.3386 (high Jan.20). While supports are aligned at 1.2968 (low Jan.31), later at 1.2818 (low Sept.7) and below that at 1.2650 (low Jun.8).

On the other hand, Stochastic Oscillator (5,3,3) seems to move faster into overbought territory. Therefore, there is evidence to expect further US dollar gains in the near term.The pair requires a close and open above the 50-DMA near 1.3218 to dilute any bearish pressure that could drag it lower back to the 200-DMA.

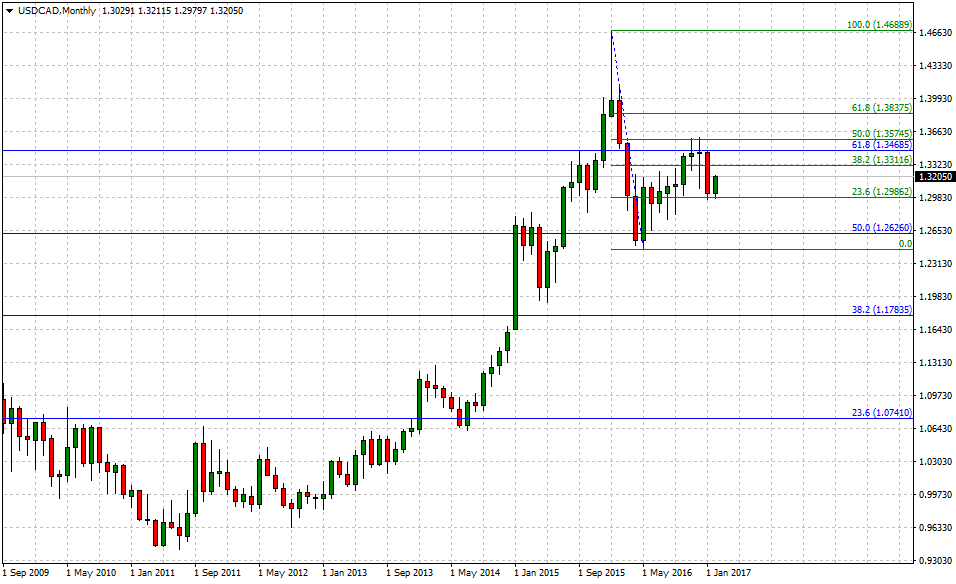

On the long term view, if the 'double Doji' candlestick formation from 1.3587 (high Nov.) and 1.3597 (high Dec.) is in fact, a relevant top, then any upside potential seems limited for this currency pair. Then, to the downside, supports are aligned at 1.2986 (short-term 23.60% Fib), later at 1.2626 (long-term 50.0% Fib) and finally below that at 1.2460 (low May.2016).

As of writing, USD/CAD trades around 1.3204, therefore upside barriers are aligned at 1.3311 (short-term 38.2% Fib), then at 1.3468 (long-term 61.8% Fib) and finally above that at 1.3574 (short-term 50.0% Fib).

FOMC minutes in the limelight - Nomura