Back

24 Jan 2023

Crude Oil Futures: Further range bound on the cards

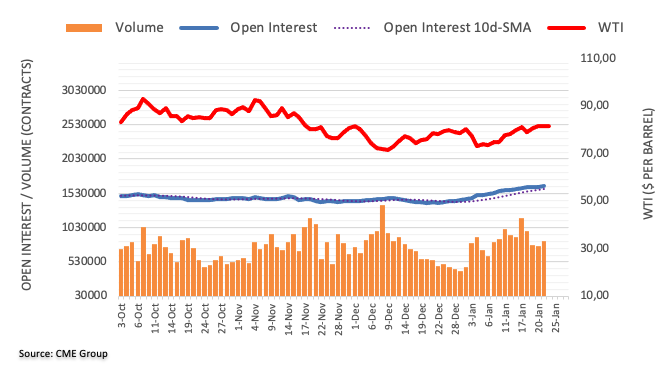

CME Group’s flash data for crude oil futures markets noted traders added around 26.7K contracts to their open interest positions at the beginning of the week, extending the upside for the second session in a row. In the same direction, volume reversed three straight daily drops and went up by nearly 70K contracts.

WTI: Upside momentum seen struggling above $80.00

Prices of the WTI started the week in an inconclusive tone around the 81.00 mark. Monday’s price action was accompanied by increasing open interest and volume, exposing further indecision in the very near term. In the meantime, it seems the 100-day SMA around the $82.00 mark continues to limit the upside bias in the commodity.